Core Features and the PING Token

This module breaks down Sonar’s core functionalities—including Portfolio Intelligence, AI agents, real-time strategy execution, and smart contract deployment. It also covers the utility and governance role of the PING token, highlighting its importance for accessing premium features, enabling DAO participation, and supporting the builder ecosystem.

Key Features of Sonar

Sonar is built around the idea that true control in Web3 doesn’t come from simply owning digital assets – it comes from understanding them. To achieve this, the platform merges intelligent infrastructure, real-time analytics, and a unified interface to deliver a comprehensive financial operating system. Each feature is not just a utility but part of a deeper strategic framework designed to guide users through their entire crypto journey. Rather than offering fragmented tools, Sonar empowers users to make informed, confident decisions with clarity and precision.

Portfolio Intelligence

At the heart of the Sonar ecosystem is its Portfolio Intelligence engine – a real-time, AI-powered analytics core that reaches across chains, wallets, and protocols. This system doesn’t just track balances; it interprets asset behavior in the context of the market, revealing the impact on strategy, performance, and risk exposure.

It calculates sophisticated metrics like volatility, drawdowns, and risk-adjusted returns, all while updating continuously. What was once accessible only to institutional desks is now delivered to users at all levels, allowing them to respond to changing market conditions with data-driven precision.

Sonar AI Agent Network

One of Sonar’s standout innovations is its AI-driven agentic network. This is not a static chatbot or search bar – it’s a collection of intelligent assistants working in the background to protect, inform, and enhance the user’s strategy. These agents monitor for anomalies, flag inefficient patterns, and even simulate outcomes based on past activity.

If a single asset begins to skew your risk profile or strategy drift occurs, the AI offers tailored suggestions before issues escalate. Over time, these agents evolve with user behavior, becoming more aligned with their goals and improving the quality of every decision made.

Unified Wallet and Multi-Chain Support

The Sonar Wallet offers a seamless, non-custodial solution that brings all assets into one place. Whether using Ethereum, BNB Chain, Polygon, or even non-EVM chains like Solana, users see everything in a unified view.

The wallet supports real-time transaction classification, gas top-ups, staking, bridging, and asset management without switching platforms. Its user-centric design ensures that while the wallet is powerful under the hood, it remains easy to use. And because it’s non-custodial, users retain complete control over their private keys and funds.

Real-Time Strategy Execution

Sonar enables users to act immediately on insights. Whether it’s swapping tokens, bridging assets, or deploying contracts, actions are executed directly within the platform’s Studio or Terminal interfaces. Every step is guided by real-time data, and users can preview the potential impact of a trade before confirming it. This approach turns analysis into action, giving users a strategic command center rather than a passive portfolio viewer.

No-Code Smart Contract Deployment

Sonar also supports creators, communities, and DAOs by providing no-code smart contract deployment tools through its Add3 integration. Users can launch tokens, staking pools, vesting schedules, and LP contracts without writing a single line of code. Each deployment is guided through a user-friendly interface and backed by pre-audited templates, making it easy to configure token supply, time locks, wallet roles, and more. This functionality lowers the barrier for innovation and lets anyone bring their project to life with confidence and speed.

Personalized Discovery and Trends Engine

The platform’s discovery engine is tuned to each user’s strategic behavior. It highlights trending tokens, monitors top-performing wallets, and alerts users to new opportunities. Whether the market is quiet or volatile, Sonar continuously analyzes sentiment and on-chain activity to bring relevant insights to the surface. Instead of relying on social media noise or hype-driven trends, users benefit from personalized, data-driven discovery tailored to their profile and risk appetite.

Security, Transparency, and Educational Support

Sonar is built with user safety and education in mind. Its built-in academy provides simple explanations for complex Web3 concepts, helping users improve their knowledge as they use the platform. A contract scanner protects users from interacting with malicious or poorly written smart contracts, while risk indicators throughout the interface provide early warnings on exposure or drift. Transparency, simplicity, and user empowerment are at the core of every product decision.

The PING Token

PING is the lifeblood of the Sonar ecosystem, acting as the access key to deeper features and premium functionality. It powers everything from advanced portfolio analytics to high-frequency AI interactions. Users who stake or hold PING unlock access to more tools—like high-speed data feeds, strategy overlays, and AI automation. This model isn’t designed for passive speculation; it rewards participation and commitment to the platform.

PING also acts as the unit of exchange within Sonar’s services. Whether deploying a smart contract via Add3 or enabling intelligent automation triggers, users pay in PING. This token-based utility removes the need for fiat subscriptions or third-party processors and replaces them with a fully integrated, seamless in-platform economy. The more value users extract from the platform, the more useful PING becomes—not just as currency, but as a layer of access and performance.

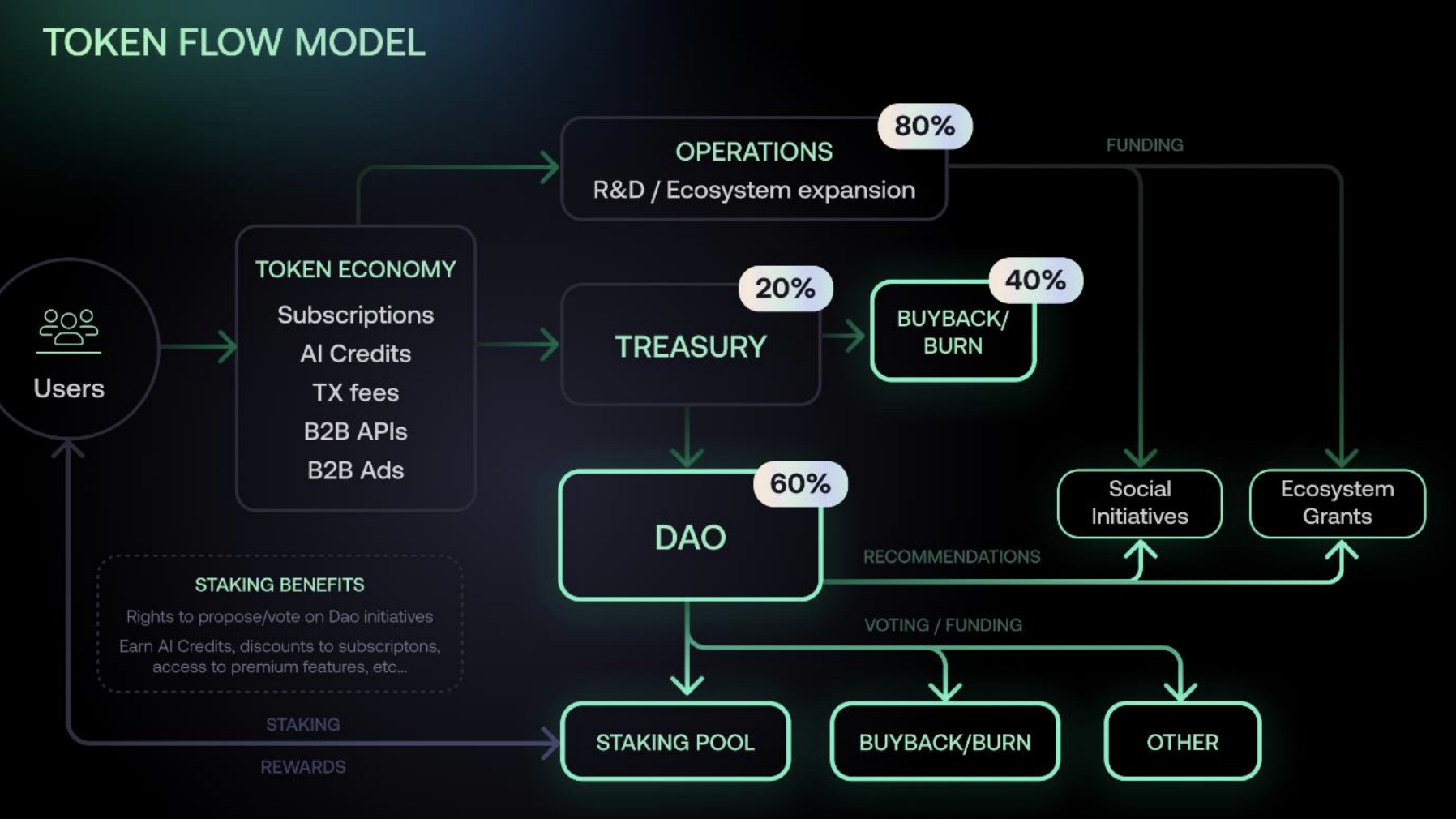

Governance and DAO Participation

Sonar integrates community governance through a participatory DAO, where PING staking grants voting rights. This allows users to influence platform direction – whether it’s which dApps to prioritize, how treasury funds are deployed, or which initiatives to support next. A significant portion of PING’s token allocation is reserved for community proposals and incentive-driven projects, giving the DAO real power over development and direction.

Unlike symbolic governance models, Sonar’s DAO is functional. It enables users to fund ecosystem growth, back meaningful collaborations, and guide the rollout of new features. This not only strengthens community alignment but ensures that Sonar evolves in step with user priorities. Active governance participants can also receive rewards, further incentivizing long-term commitment.

Enabling the Builder Ecosystem

PING is more than a user token—it also fuels Sonar’s builder ecosystem. Developers who want to integrate with Sonar’s infrastructure, indexers, or dApp discovery layer can stake or use PING to do so. This approach ensures that the Portal remains open to innovation while maintaining performance and trust. Builders benefit from lower deployment costs, shared revenue models, and exposure to Sonar’s growing user base.

Whether it’s launching a governance token, managing vesting for a GameFi project, or offering staking-as-a-service, developers can build directly into Sonar without having to reinvent the backend. PING enables this by acting as both a cost reducer and a strategic connector—bringing builders, tools, and users together in one composable environment.

Tokenomics and Long-Term Model

PING has a capped total supply of 600 million tokens, with a transparent allocation across public sales, DAO funds, staking rewards, builder incentives, and operational needs. There are no backdoor minting functions or artificial inflationary models. Everything about the supply structure is designed to support long-term platform health and community participation.

The token economy follows a natural feedback loop: as more users interact with Sonar’s advanced features, the demand for PING rises. As builders deploy dApps, infrastructure load and token utility increase. As more participants stake and vote, the DAO becomes stronger. Each action within the ecosystem contributes to PING’s functional value, making the token’s relevance directly proportional to its real-world use and not market speculation.