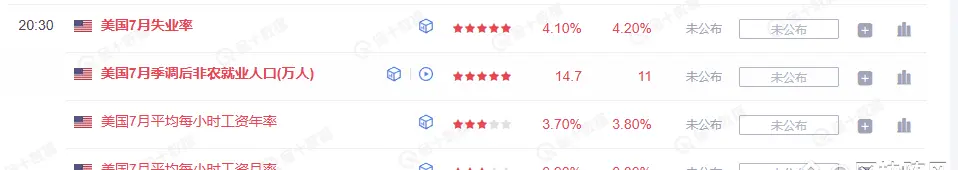

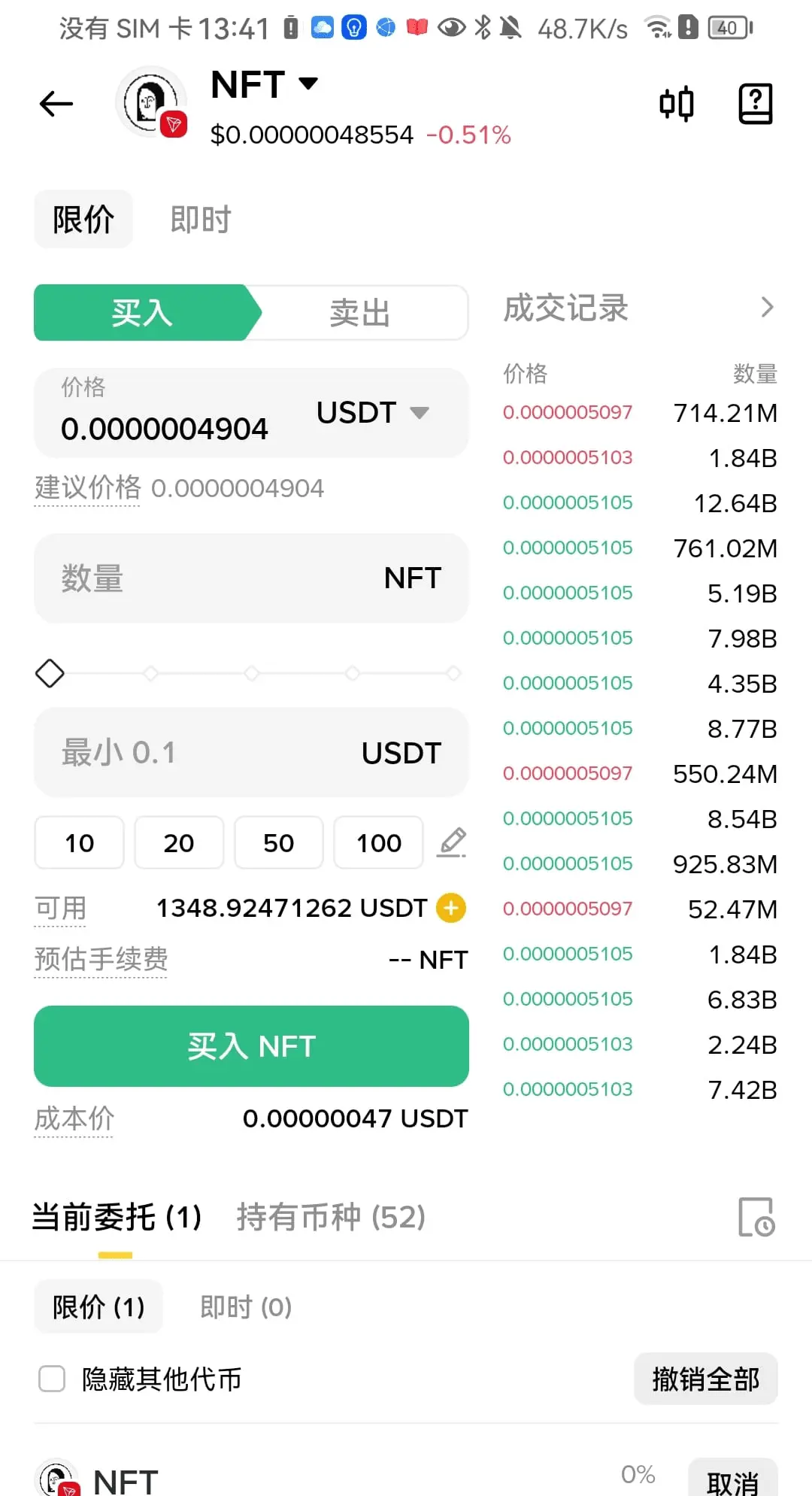

In the Crypto Assets and stock markets, the strategy of holding assets long-term unconditionally is often overly romanticized; in reality, this is a high-risk behavior. While there are occasional lucky individuals who achieve considerable gains through long-term holding, such cases are rare. In most instances, blindly holding long-term can lead to significant financial losses.

The essence of the market is filled with uncertainty. Even if asset prices rise, it is often difficult for investors to accurately determine the best time to sell, leading them to miss out on optimal profit opportunities

View OriginalThe essence of the market is filled with uncertainty. Even if asset prices rise, it is often difficult for investors to accurately determine the best time to sell, leading them to miss out on optimal profit opportunities