Articles

AllAltcoinsBitcoinBlockchainDeFiEthereumMetaverseNFTsTradingTutorialFuturesTrading BotsBRC-20GameFiDAOMacro TrendsWalletsInscriptionTechnologyMemeAISocialFiDePinStableCoinLiquid StakingFinanceRWAModular BlockchainsZero-Knowledge ProofRestakingCrypto ToolsAirdropGate ProductsSecurityProject AnalysisCryptoPulseResearchTON EcosystemLayer 2SolanaPaymentsMiningHot TopicsP2PSui EcosystemChain AbstractionOptionQuick ReadsVideoDaily ReportMarket ForecastTrading BotsVIP Industry Report

XRP Price Faces Short-Term Pressure: Technical Analysis and Regulatory Headwinds

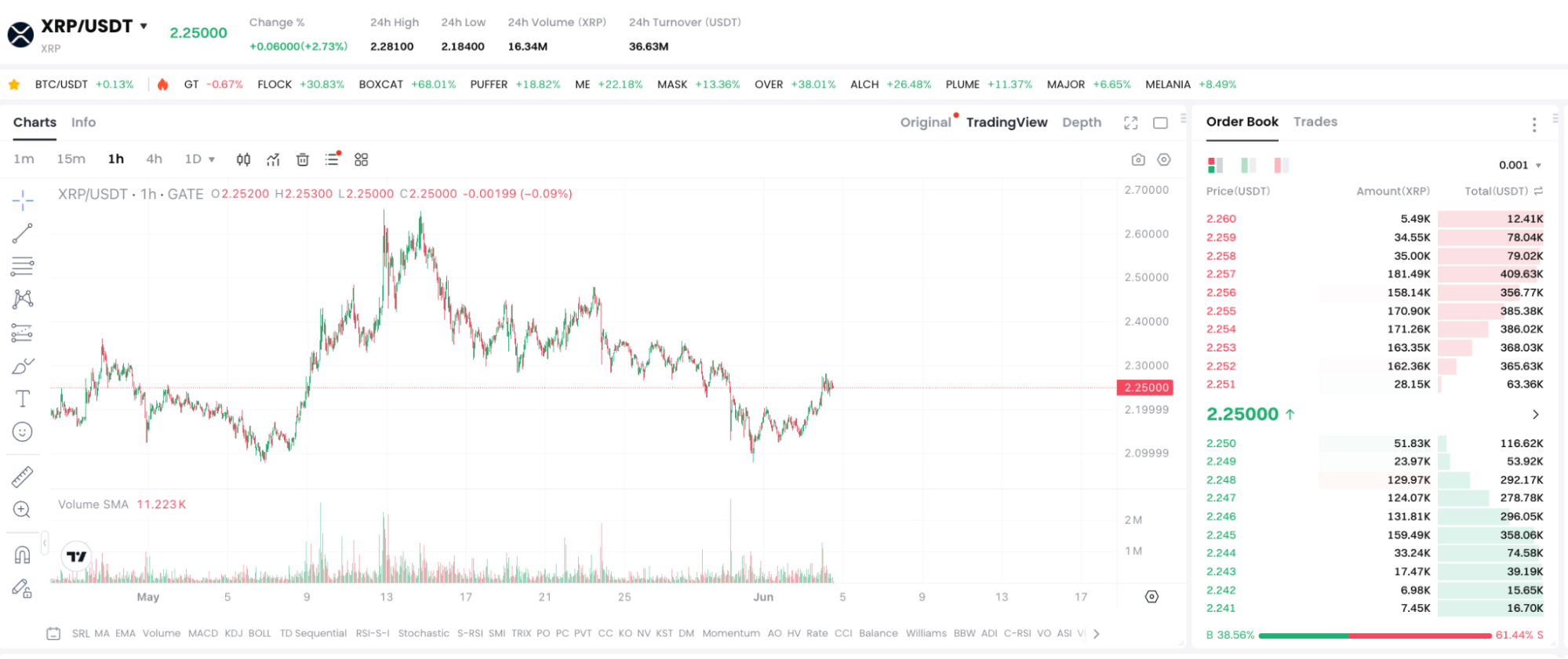

Recently, the XRP Price has been oscillating between $2.65 and $2.27, with technical indicators showing increasing downside risks. With the SEC regulatory conference and the release of the Federal Reserve meeting minutes, the market may welcome a new round of volatility.

1. XRP Recent Price Overview

Figure:https://www.gate.com/trade/XRP_USDT

As of early June 2025, XRP Price has been consolidating in the range of $2.65 to $2.27 for nearly three weeks, with the latest price around $2.28. The upper range has faced multiple resistance at $2.65, while the key support level is at $2.27, coinciding with the 100-day EMA. A break below this line shows clear signs of bearish dominance.

2. Technical indicators show a downward trend

- MACD: A death cross occurred on May 20, with the blue MACD line crossing below the red signal line, and the green histogram continuing to expand below the zero axis, indicating an increase in bearish momentum.

- RSI: The Relative Strength Index has fallen below the 50 midline, currently at around 45. If it further drops below 30, it indicates oversold conditions, and the price may accelerate downward.

- EMA Indicator: The 50-day EMA (approximately $2.29) and the 100-day EMA (approximately $2.27) create dual resistance. If short-term bulls cannot break through, the possibility of continued consolidation increases.

3. The Impact of Policies and Macroeconomic Factors

- SEC Regulatory Conference: On June 5, the SEC will hold the third Digital Assets and Tokenization Conference, with committee member Hester Peirce and other experts participating, focusing on compliance and innovation. Ripple has submitted a letter to the SEC’s crypto working group, calling for the establishment of a clear regulatory framework, but it is difficult to change market sentiment in the short term.

- Federal Reserve Meeting Minutes & PCE Data: The minutes of the May FOMC meeting will be released this Wednesday (June 4), and core PCE inflation data will be published on Friday (June 6). If inflation exceeds expectations, it will raise interest rate hike expectations, tighten liquidity, and may put pressure on digital assets such as XRP.

4. Support Below and Potential Targets

- $2.17: Near the SuperTrend dynamic support line, once it breaks, the short-term trend will turn clearly bearish.

- $2.07: 200-day EMA support, if broken, market bearish confidence will further strengthen.

- 1.61 USD: The low point on April 7, a historical concentration area for buying, with a potential rebound in the short-term.

- $1.00: If a “bear flag” breakdown pattern forms, the target price is estimated to be around $1.00, with a decline of about 55%. However, it is important to pay attention to market sentiment and the macro environment when the price reaches this level.

5. Investor Operation Suggestions

- Pay attention to key news: Investors need to closely monitor SEC regulatory developments and Federal Reserve data. Once there is any favourable or Unfavourable Information, XRP Price may fluctuate rapidly.

- Short-term trading: If the price holds above the support at $2.27, you can take short-term long positions at the lower end of the range, setting a stop loss at $2.25; if it breaks below, you need to decisively stop loss to avoid a deep pullback.

- Medium-term layout: If a significant pullback occurs and the regulatory environment becomes clearer, consider gradually accumulating near $2.07 on dips, keeping the risk within an acceptable range.

- Risk Warning: Beginners should pay attention to position management, high leverage operations are not recommended, and do not chase up or kill down. Understanding “XRP Price” does not constitute investment advice, it is for reference only.

Author: Max

* The information is not intended to be and does not constitute financial advice or any other recommendation of any sort offered or endorsed by Gate.

* This article may not be reproduced, transmitted or copied without referencing Gate. Contravention is an infringement of Copyright Act and may be subject to legal action.

Start Now

Sign up and get a

$100

Voucher!