Why Is Crypto Down Today? Musk–Trump Tensions Escalate, Sparking Market Panic

Why did the Crypto Assets fall today?

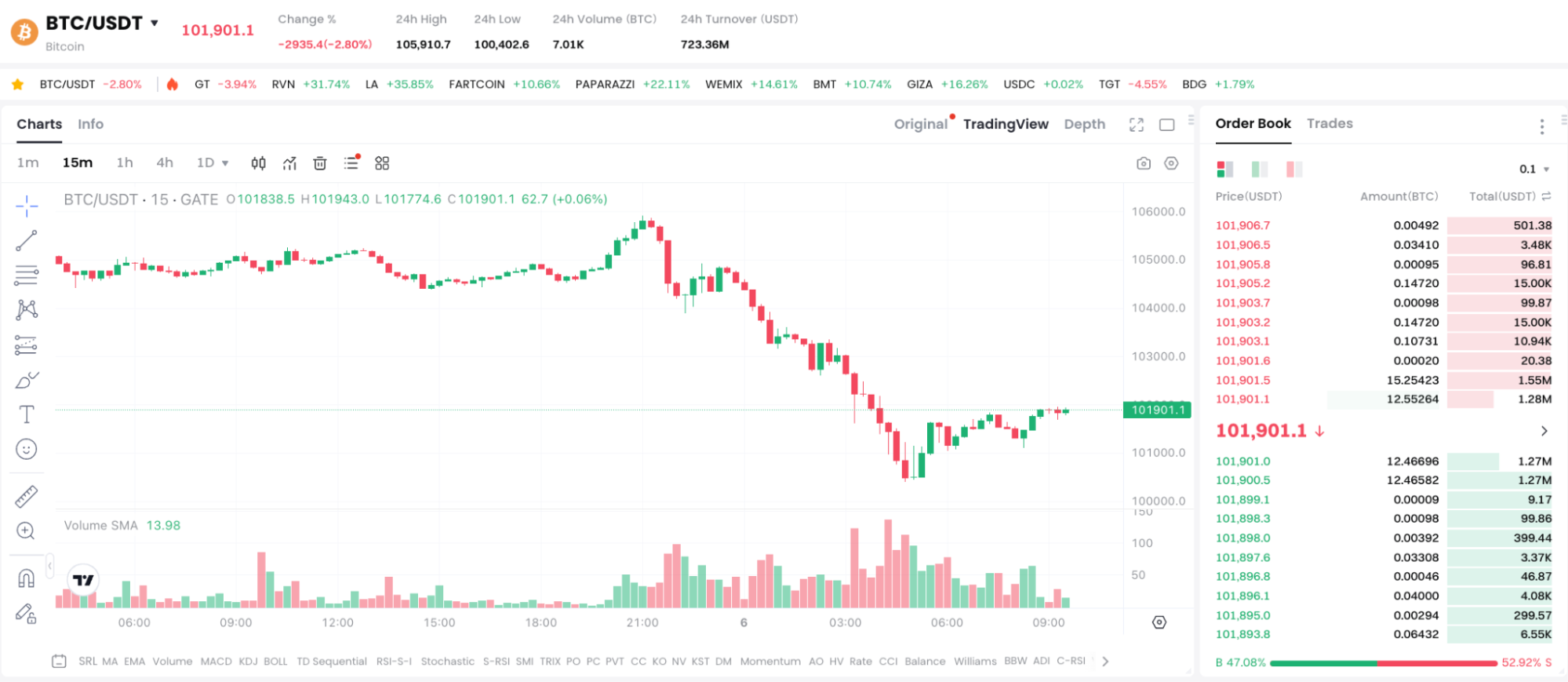

Bitcoin hits new lows, market sentiment changes rapidly.

Figure:https://www.gate.com/trade/BTC_USDT

As of the time of publication, the price of Bitcoin (BTC) has fallen to around $100,400, marking the lowest point in the past week. This is a drop of more than 5% from this week’s high of $105,910. This round of fall has broken the previously maintained oscillating upward structure in the market, significantly weakening the confidence of bulls.

Ethereum (ETH) has fallen to around $2,400. Although the decline is not as significant as BTC, it has also erased some of the recent gains.

The conflict between Musk and Trump escalates, raising concerns about policy.

Figure:https://x.com/elonmusk/status/1930703865801810022

According to The BlockBeats, on June 6, the conflict between Musk and Trump became public on social media. Musk stated that he would not fund Trump’s campaign and questioned his stance on regulatory policies in the crypto assets industry. Trump retaliated by saying, “Musk always comes to me for help,” and this dispute quickly sparked market associations—political risks in the crypto assets market have been rising since the end of 2024.

Market concerns that if there are changes at the policy level, such as Trump returning to the White House and taking actions unfavorable to the Crypto Assets industry, it will severely impact the progress of the currently approved Bitcoin and Ethereum spot ETFs, and will also disrupt the flow of funds.

Spot ETF capital flows diverge: ETH continues to flow in, BTC shows weak growth.

According to SoSoValue data, on June 4th, the US spot Bitcoin ETF achieved a net inflow for the second consecutive day, with total assets reaching $44.57 billion. However, it is important to note that there is a significant divergence among the leading funds: BlackRock saw a net inflow of $28.396 million, while Fidelity experienced a net outflow of $19.7 million.

In contrast, the Ethereum spot ETF has recorded net inflows for thirteen consecutive trading days, with an additional $56.98 million on June 4, mainly from BlackRock’s contribution of $73.18 million.

This indicates that, although the overall market is weak, some funds are shifting towards the Ethereum ecosystem, while the funding support for Bitcoin is decreasing.

Technical Level: The market is at a critical resistance and divergence convergence point.

From a technical chart perspective, Bitcoin has repeatedly attempted to breach $105,000 but has failed, and the current price has fallen below a key support range, indicating that bearish forces are gradually strengthening. Glassnode data shows that long-term holders are beginning to take profits in stages, especially as the large trapped positions around $110,000 have become the main resistance above the market.

At the same time, data from Derive.xyz shows that currently 57% of BTC contracts in the market are put options, reflecting a general pessimism among traders regarding short-term market trends. The market sentiment indicator “Greed and Fear Index” has also quickly dropped from extreme greed to a neutral fear zone, indicating that the market is entering a high volatility range.

Market Outlook: Focus on Federal Reserve Policy and Political Dynamics

Despite the limited magnitude of the current pullback, investors need to pay attention to the upcoming U.S. employment data and changes in Federal Reserve policy. In particular, Trump’s renewed call for interest rate cuts on Truth Social is viewed as a signal of intensified market policy maneuvering.

If expectations for future interest rate cuts strengthen, it may be favorable for risk assets in the short term; conversely, once signals of policy tightening become clear, it will lead to more capital outflow, exacerbating the adjustment pressure on Crypto Assets.

Conclusion

In summary, “Why are Crypto Assets falling today” is not only due to technical corrections but also the combined effect of political differences between Musk and Trump, ETF fund transfers, and structural pressures in the market. In the short term, the market remains in a turbulent phase, and investors should operate cautiously while paying attention to the potential impacts of macroeconomic and policy changes.