Gate Research: BTC Consolidates at High Levels, AURA Soars 180x, Sparks Mid-Cap Token Frenzy

Overview

Gate Research analyzed the market trends and popular airdrop projects between June 3 and June 16, 2025. During this period, the crypto market remained in a high-level consolidation phase without a clear systemic recovery. However, driven by selective narratives, mid- and small-cap tokens delivered strong performances. The average gain among the top 500 tokens reached 16.65%, with those ranked 301–400 soaring over 46%, highlighting investors’ clear preference for narrative-driven assets with speculative potential.

AURA surged more than 180x, while tokens like CONSCIOUS saw trading volumes spike over 100-fold, reflecting strong price-volume synergy. In contrast, some tokens experienced volume growth without corresponding price increases, suggesting market divergence in future expectations. Overall, the market showed a structure of “rotating narratives + major cap stability,” with volume anomalies remaining a key signal for short-term opportunities.

Against this backdrop, several promising projects launched new airdrop campaigns, including OpenSea (the leading NFT marketplace), Treehouse (a DeFi rewards platform), Recall (a decentralized data protocol), and Sophon (an on-chain identity platform). All have opened participation portals. This report outlines the features and participation methods of these projects, helping users capture potential airdrop rewards and position for longer-term opportunities during the current market rebound.

Crypto Market Overview

According to CoinGecko data, from June 3 to June 16, 2025, the cryptocurrency market remained range-bound, with prices consolidating at higher levels and showing no clear signs of recovery. During this period, BTC briefly reached a high of 110,000 USDT—an increase of nearly 4%—before pulling back to around 106,000 USDT, indicating that the market remains in a state of tug-of-war between bulls and bears. [1]

On the macroeconomic front, the Federal Reserve’s FOMC minutes released in late May maintained a hawkish tone. Officials remained cautious about the inflation outlook, with core PCE steady at 2.6%, and expectations that inflation will not return to target levels until 2027. Additionally, downgraded GDP growth and a higher unemployment rate have raised concerns about an economic slowdown and delayed rate cuts, weighing on risk asset momentum.

Geopolitically, the outbreak of military conflict between Iran and Israel has heightened global risk aversion, leading to gains in traditional safe-haven assets such as gold. However, the event has not yet served as a decisive driver for a new crypto rally. Market participants are still watching macroeconomic data and capital absorption for stronger signals.

On the regulatory side, sentiment turned more optimistic. The GENIUS Stablecoin Act passed a procedural vote in the U.S. Senate on June 12, signaling a structural shift in regulatory stance and a clearer path for future legislation. The following day, the SEC officially withdrew several proposals related to DeFi and crypto custody. This move was widely interpreted as positive for the DeFi sector.

In summary, the crypto market is currently navigating a phase of consolidation and regulatory rebalancing. While fundamental momentum remains weak, easing policy uncertainty and gradually improving capital inflows may help build momentum heading into the second half of the year. In the short term, investors should continue to closely monitor volume trends and macroeconomic signals.

1. Overview of Price Performance

This article presents grouped statistics on the top 500 tokens by market capitalization, analyzing their average price changes between June 3 and June 16, 2025.

The overall average return across all tokens was 16.65%. Tokens ranked 301–400 in market capitalization performed the strongest, with an average increase of 46.85%, significantly outperforming other segments. This indicates that some lower-cap tokens attracted heightened attention and substantial capital inflows. Tokens ranked 101–200 and 401–500 also showed solid performance, with average gains of 9.99% and 9.91%, respectively, reflecting relatively stable growth. Meanwhile, the top 100 mainstream assets posted a moderate average gain of 8.26%, suggesting that institutional interest remains steady.

In contrast, tokens ranked 201–300 showed more muted performance, with an average increase of 8.23%, slightly below other groups. Overall, the mid- and small-cap segment exhibited localized bursts of performance, but capital rotation has yet to broaden across the board. Market enthusiasm remains concentrated in specific themes and sectors, and the current rebound still reflects selective sentiment rather than a full recovery.

Note: Market capitalization data is based on CoinGecko. Tokens ranked in the top 500 were divided into groups of 100 (i.e., ranks 1–100, 101–200, etc.). The average price change of each group was calculated between June 3 and June 16, 2025. The overall average (16.65%) represents the simple mean of all individual token returns and is not weighted.

Figure 1: The overall average gain was 16.65%, with tokens ranked 301–400 in market capitalization performing the best—posting an impressive average increase of 46.85%.

Top Gainers and Losers

Over the past two weeks, while the overall crypto market has remained in a consolidation phase, capital rotation has been notably active, with several small-cap tokens delivering outstanding performance. The market exhibited clear structural divergence, with AURA topping the gainers list—its price skyrocketing by over 18,800%, far surpassing other tokens. This indicates an intense influx of speculative capital.

AURA is a memecoin deployed on the Solana blockchain and launched on May 30, 2024. It is themed around the viral TikTok concept of “aura,” highlighting the fusion of social influence and personal charisma. The project has since evolved into a community-driven movement with strong cult-like followings and is currently one of the most talked-about meme tokens within the Solana ecosystem, enjoying high engagement on X (formerly Twitter).[2]

Other top performers include 0X0 (+119.76%), AB (+83.68%), and PCI (+76.30%), reflecting the market’s strong preference for high-volatility and highly narrative-driven assets. The top ten gainers are mainly concentrated in categories such as memecoins, AI, and social minting—projects with active communities and speculative potential that are currently favored by capital inflows. Additionally, tokens like REKT, VENOM, and DAKU also exhibited strong high-beta rallies, indicating robust momentum in selective narratives.

In contrast, the worst performers were largely projects suffering from fading hype or outdated narratives. ZKJ plunged by 83.95%, followed by KOGE (-56.11%), MASK (-46.97%), and SOS (-45.22%), highlighting how assets lacking fresh narratives or liquidity come under heavy selling pressure as speculative interest fades.

Overall, while the market has yet to show broad-based recovery, the capital allocation structure remains clear. Tokens with strong narratives and active communities continue to offer short-term trading opportunities, while those without renewed storylines or liquidity are prone to steep declines, making divergence a key feature of current market conditions.

Figure 2: The standout performer is AURA, a memecoin on the Solana blockchain, with a staggering gain of over 18,800%.

Relationship Between Market Cap Ranking and Price Performance

To further analyze the structural characteristics of token performance in the current market cycle, we created a scatter plot of the top 500 tokens by market cap. The x-axis represents market cap ranking (lower values indicate higher market cap), while the y-axis shows the price change from June 3 to June 16 on a logarithmic scale. Each dot represents a token—green for gains and red for losses.

From the overall distribution, approximately 90% of tokens posted positive returns, with gains primarily concentrated in the 10% to 80% range, indicating a clear systemic rebound across the market. Notably, AURA surged over 18,000%, standing out as an extreme outlier, while PCI also ranked among the top performers—highlighting that some mid- and small-cap tokens remained key focal points of speculative capital.

Tokens in the mid-cap range (approximately ranks 100–400) were the most densely clustered and generally recorded double-digit gains. This reflects a “broad allocation” approach by market participants, favoring assets with strong community engagement or compelling narratives. In contrast, underperformers such as LA and DLC lacked narrative support or represented earlier hype cycles that have since faded, leading to profit-taking or liquidity exhaustion.

In summary, the current rebound has not been led by large-cap mainstream tokens, but instead exhibits a mainstream stability, mid-to-small cap activity” structure. Capital continues to favor tokens with room for narrative-driven speculation, strong community foundations, or novel mechanisms.

Figure 3: Most tokens recorded positive returns this cycle, with gains primarily concentrated in the 10%–50% range.

Top 100 Market Cap Leaders

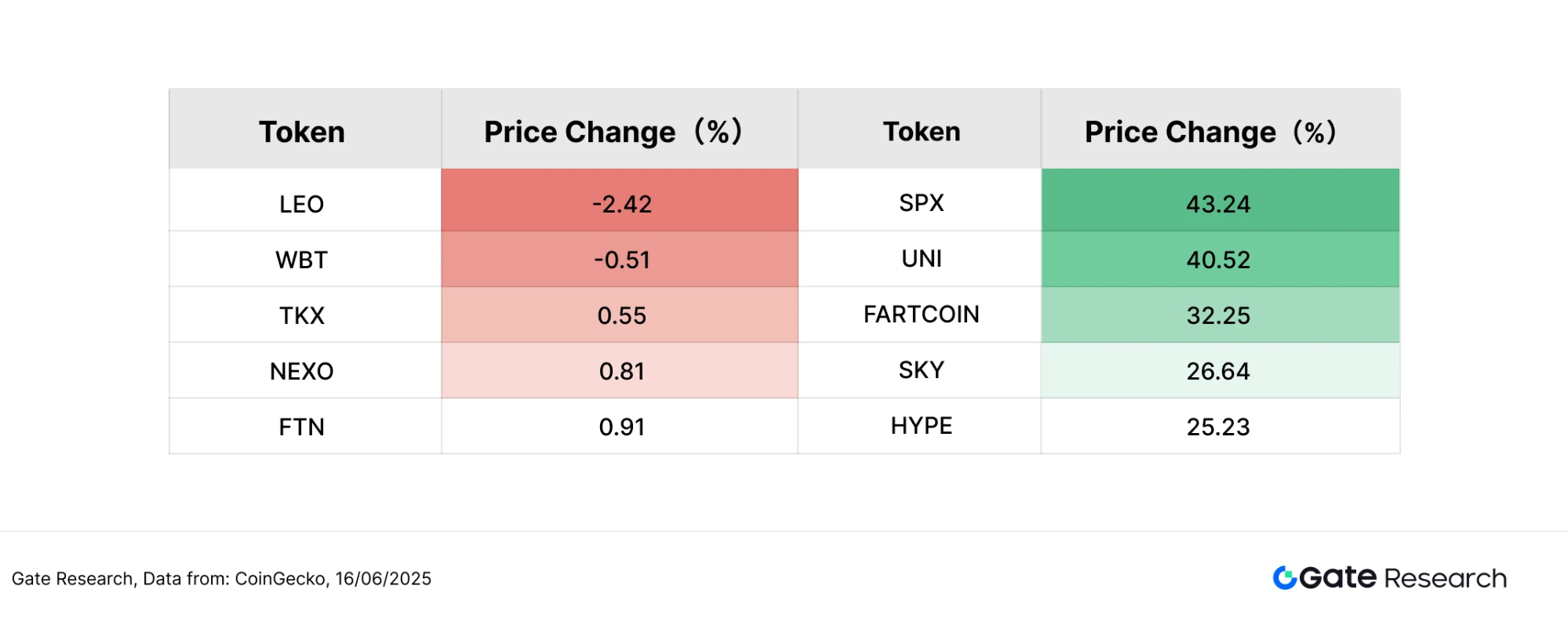

Amid the current consolidation phase, the top 100 tokens by market cap have largely maintained stable performance. Excluding stablecoins and LSDs (liquid staking derivatives), the top five gainers during this period were SPX (+43.24%), UNI (+40.52%), FARTCOIN (+32.25%), SKY (+26.64%), and HYPE (+25.23%). These figures highlight that capital inflows remained focused on mainstream projects with strong narratives, active trading, or novel concepts.

UNI stood out in particular, driven by rising governance revenue and improved liquidity, along with Uniswap Labs’ rollout of its smart wallet. The wallet features one-click swaps, gas sponsorship, and token-agnostic payments, significantly enhancing the user experience. Built on Ethereum’s EIP-5792 standard, it is expected to gain further traction with the upcoming Pectra upgrade. These innovations have strengthened user engagement and market confidence in the Uniswap ecosystem, supporting UNI’s strong performance during this cycle. [3]

FARTCOIN, while bearing meme characteristics, revolves around an AI dialogue experiment and its “Terminal of Truth” mechanism. This, combined with viral community engagement and interactive dynamics, attracted substantial capital in a short time and exhibited high volatility. Meanwhile, HYPE, the native token of the Hyperliquid ecosystem, benefitted from increased platform activity and growing narrative traction, showing strong beta characteristics.

On the flip side, some top 100 tokens underperformed despite the broader market staying elevated. The top five laggards were LEO (–2.42%) and WBT (–0.51%), while TKX (+0.55%), NEXO (+0.81%), and FTN (+0.91%) posted limited gains. These tokens appeared to act as defensive plays amid capital rotation, offering price stability even without much upside momentum.

Overall, the leading performers in this cycle tended to combine liquidity, narrative strength, and structural innovation—appealing to capital seeking high-reaction, high-visibility assets. Conversely, defensive tokens demonstrated resilience in a choppy market, underscoring a dynamic of “structural diffusion and rotational divergence” in capital flows.

Figure 4: Top performers among the top 100 market cap tokens were mainly those with active trading or strong narratives, reflecting a capital preference for topical and responsive mainstream assets.

2. Volume Surge Analysis

Trading Volume Growth Analysis

Beyond analyzing price performance, this section explores the trading volume dynamics of selected tokens during the current market cycle. Using pre-rally volume levels as the baseline, we calculate each token’s volume growth multiple as of June 16 to assess shifts in market interest and trading activity.

The data shows that AURA, a meme token on Solana, recorded the most significant surge in trading volume—growing by over 1,600x. Paired with its astounding 18,000%+ price increase, AURA clearly emerged as a focal point of speculation and market attention during this cycle.

CONSCIOUS followed closely in trading volume growth, with over a 100-fold increase despite experiencing a 4.6% price decline over the past two weeks. This indicates a strong influx of short-term capital and reflects the market’s temporary focus on its thematic narrative. Notably, CONSCIOUS is not a typical financial asset—it is a Web3 project that integrates mindfulness practices with blockchain technology. Its mission is to promote mental wellness and build a decentralized ecosystem centered on psychological well-being. By diverging from conventional crypto use cases and offering a differentiated value proposition, it has begun to carve out a unique position in the market.

Other tokens such as ETHX (+56.17x), PCI (+36.35x), and USDY (+26.06x) also posted significant volume expansions, suggesting heightened trading interest driven by compelling narratives or emerging themes. In terms of market cap, these tokens generally fall within the 100–400 range—large enough to support liquidity but small enough to remain highly volatile and reactive. Such characteristics make them ideal targets for short-term speculative capital.

While a spike in trading volume does not guarantee sustained price increases, it often signals the beginning of a new trend—especially for tokens with strong community backing and thematic relevance. Volume anomalies, therefore, serve as a crucial metric for identifying rising market interest and sector rotations, particularly within the mid- and small-cap segments.

Figure 5: Solana-based memecoin AURA led with over a 1,600x increase in trading volume, indicating extremely high market engagement.

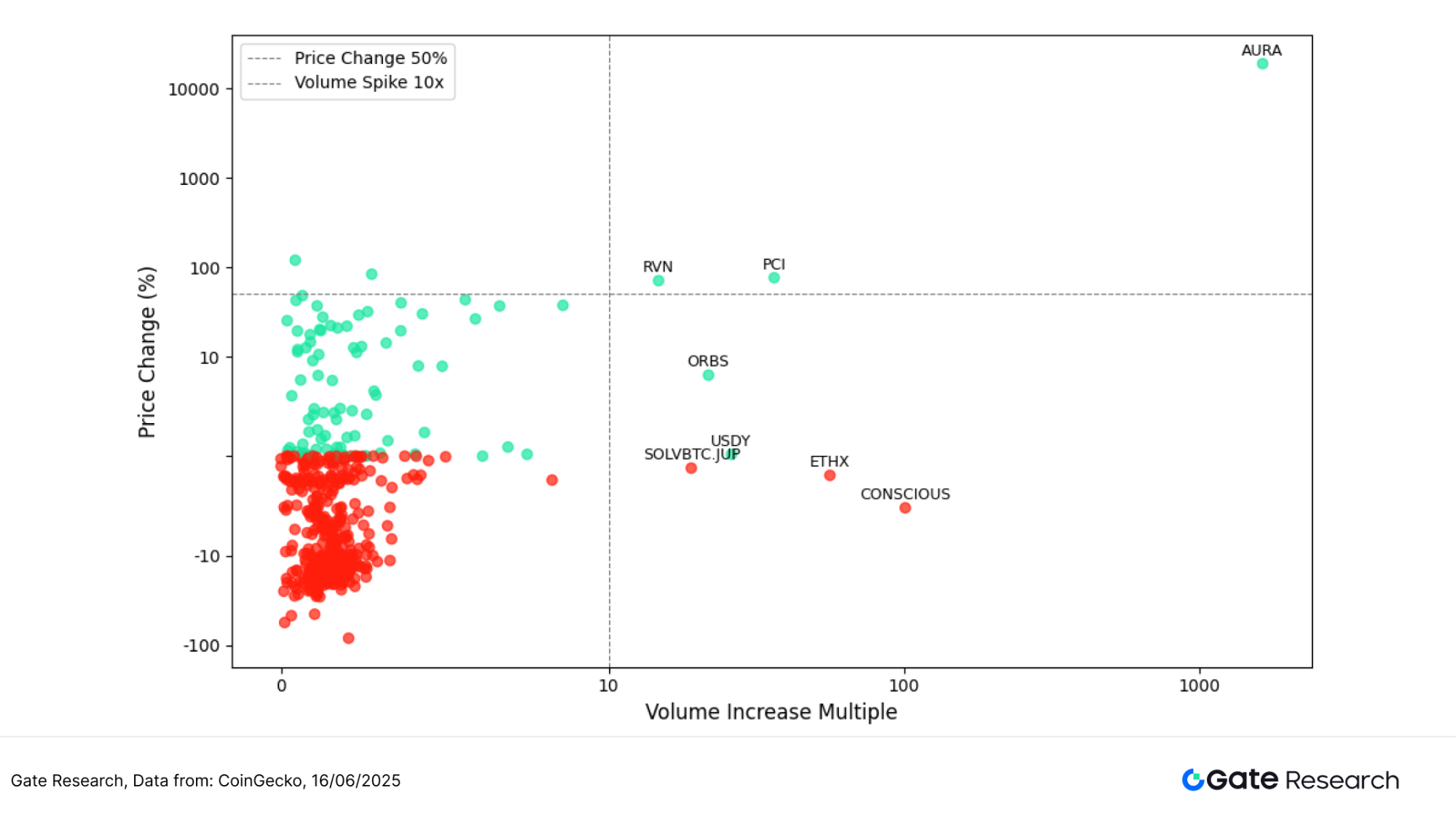

Volume-Price Relationship Analysis

To further examine the correlation between trading volume growth and price movement, we present a scatter plot comparing the Volume Increase Multiple (x-axis) with the Price Change Percentage (y-axis). Both axes use a symmetrical log scale to better capture extreme variations.

The chart reveals that most tokens with significant price increases also experienced notable spikes in trading volume, indicating the market’s rapid response to narrative-driven themes, short-term trading opportunities, or community hype. For instance, AURA occupies an extreme position in the upper-right quadrant, with a 1,600x surge in volume and an 18,000% price increase—an archetypal “volume-backed rally.” Tokens like PCI and RVN, with mid- to low-market caps, also fall within this zone, demonstrating how capital tends to concentrate on trending assets during structural sector rotations.

In contrast, several tokens—such as CONSCIOUS, ETHX, and USDY—saw their volumes increase more than 25x, yet their prices either stagnated or declined. This “high-volume, low-price” pattern suggests temporary capital inflows lacking sustained buying pressure or bullish conviction. These moves often reflect short-lived hype or narrative fatigue, especially when unaccompanied by strong project updates or continuous community engagement.

The lower-left quadrant is populated by assets with low volume and minimal price changes, showing that despite the thematic momentum in this cycle, the rally has not broadly extended across all tokens. Non-mainstream and non-narrative tokens remain in a low-activity or wait-and-see phase.

Overall, the volume-price correlation remains a key indicator of market interest and sentiment in the current cycle. Tokens in the upper-right quadrant exhibit a strong “narrative + momentum” signal and are more likely to attract momentum traders. Conversely, assets in the lower or middle areas may require further confirmation of trend initiation. In particular, volume anomalies—especially among mid- and small-cap tokens—often serve as early indicators of narrative-driven breakouts, making them valuable inputs for short-term strategies.

Figure 6: Tokens such as AURA, PCI, and RVN appear in the upper-right quadrant, exemplifying the classic “volume-backed rally” pattern.

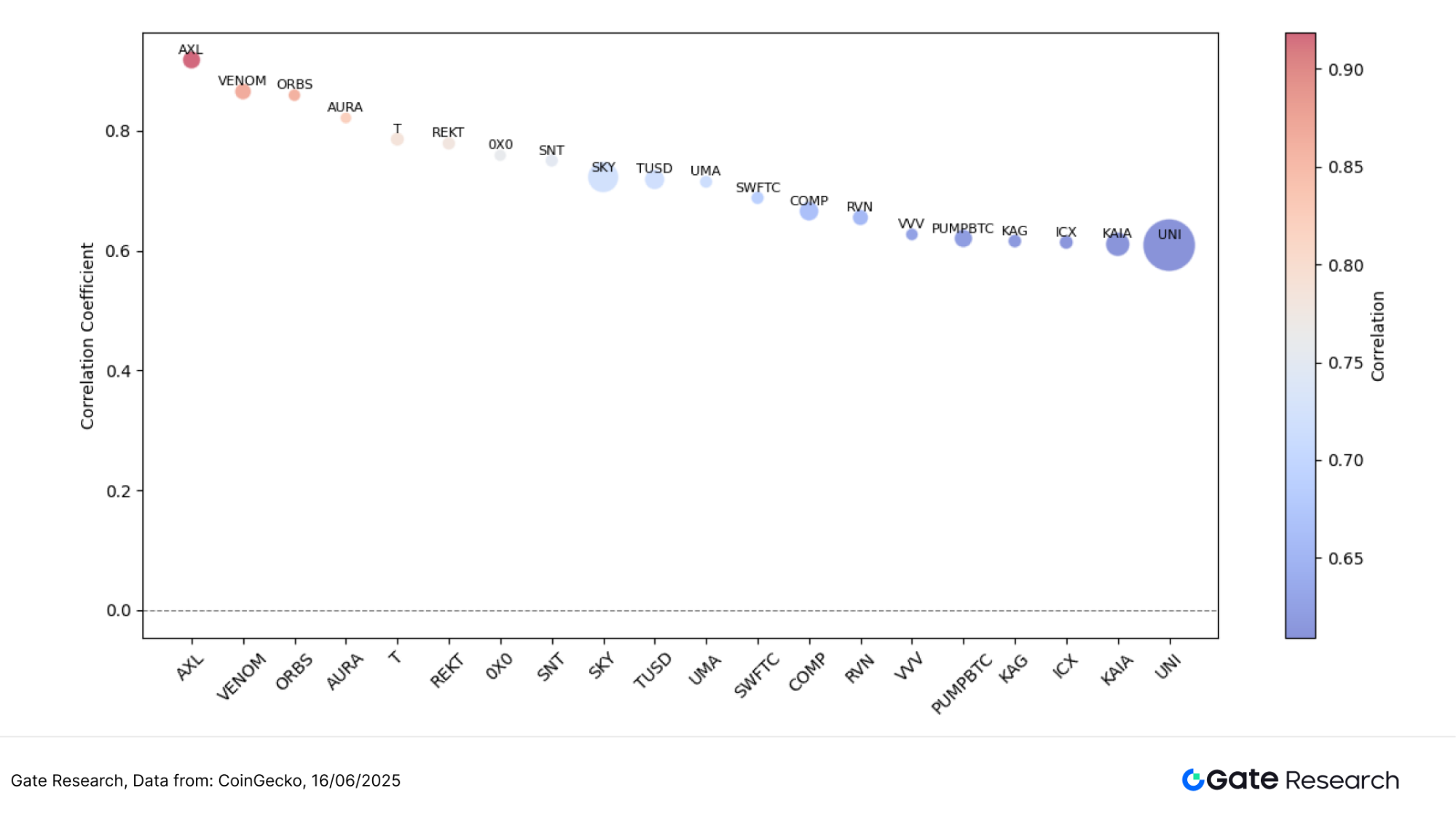

Correlation Analysis

After examining the direct relationship between volume changes and price performance, this section explores the structural correlation between the two metrics from a statistical perspective. To assess whether capital activity has a systemic impact on token performance, we introduce the “Volume-to-Market Cap” ratio as a proxy for relative trading activity, and calculate its correlation with price change. Through this correlation analysis, we aim to provide deeper structural insights into which tokens are more sensitive to liquidity flows and whether there is a consistent pattern between trading activity and price movements—thus offering investors a more data-informed perspective.

The chart reveals that the correlation between volume-to-market cap and price change is generally high, often ranging between 0.65 and 0.90, suggesting that trading activity significantly impacts price performance. In the scatter plot, color denotes correlation strength (with red indicating higher values and blue lower), while bubble size reflects token market capitalization.

Tokens located in the upper-left quadrant—such as AXL, VENOM, ORBS, and AURA—exhibit correlation coefficients above 0.85 and relatively small bubble sizes, indicating these mid- to small-cap tokens experienced sharp volume increases alongside price gains. These “volume-price linked” tokens are typically focal points for speculative capital during narrative-driven rallies.

On the right-hand side, tokens like UNI, KAI, and ICX show slightly lower correlations (around 0.65–0.70), but their larger bubble sizes reflect higher market caps. These tokens tend to move more steadily, with lower beta, and are favored for their liquidity and institutional positioning—even if their price movements are less reactive to volume spikes.

Overall, the visualization illustrates a clear “narrative-driven + market cap-diffused” market structure: mid- to small-cap tokens exhibit greater volatility and volume-price coupling, while large-cap assets provide more stable, liquidity-backed performance. Investors can use this information to distinguish between short-term speculative opportunities and medium-term strategic plays, leveraging both volume behavior and price correlation to refine their trading strategies.

Figure 7: Mid- to small-cap tokens such as AXL, VENOM, ORBS, and AURA demonstrate strong volume-price correlation, highlighting concentrated capital interest.

In summary, while the crypto market has yet to show signs of a full-scale rebound, the ongoing structural capital rotation and strong performance of mid- and small-cap assets indicate that market interest remains active. Shifts in trading volume and narrative-driven themes have become key indicators for identifying short-term opportunities. Beyond the active spot market, several potential airdrop campaigns are also underway, spanning popular sectors such as NFTs, social platforms, and AI. For users who can stay ahead of the curve, this presents a window to strategically position themselves during the consolidation phase and capture future token rewards. The following section outlines noteworthy airdrop opportunities and how to participate.

Airdrop Highlights

This article highlights notable projects with strong airdrop potential during the period from June 3 to June 16, 2025. Most of these projects have received backing from prominent investment institutions and are expected to launch token airdrops within the coming year. Featured Web3 initiatives include OpenSea (a leading global NFT marketplace), Treehouse (a DeFi rewards platform), Recall (a decentralized data protocol), and Sophon (an on-chain identity platform). These projects have either launched or confirmed their airdrop plans, offering users diverse avenues for participation and potential rewards. The following section provides an overview of each project, its airdrop progress, and participation steps to help users stay ahead of market trends and capture early-stage benefits.

OpenSea

OpenSea is the world’s leading NFT marketplace, enabling users to create, trade, and showcase a wide range of non-fungible token assets. The platform supports multiple blockchains—including Ethereum, Polygon, and Base—and continues to expand its cross-chain compatibility to enhance the user trading experience. OpenSea also offers a comprehensive suite of creator tools and aggregation features, covering various categories such as digital art, collectibles, and in-game assets.[4]

Currently, OpenSea is rolling out the Voyages Rewards Program, which integrates an XP and Treasures system to boost user engagement and platform loyalty. This gamified initiative allows users to earn XP by performing designated actions on the platform, which can be used to unlock Voyages of varying rarities—Common, Rare, Epic, and Legendary. Legendary Voyages typically appear as “Shipments” and offer the chance to obtain exclusive rewards called “Treasures,” which are displayed directly on the user’s profile.

How to participate:

- Visit the OpenSea Voyages task page and connect your wallet and social accounts.

- Complete designated tasks (e.g., purchasing NFTs) to earn XP and unlock rewards.

Treehouse

Treehouse is a DeFi platform that integrates on-chain operations with a gamified rewards system, aiming to boost user engagement through interactive design. The platform allows users to provide liquidity and stake assets across multiple blockchain networks. Through its native points system called Nuts, Treehouse incentivizes continued user activity. It also incorporates a Buff and Badge mechanism that grants additional rewards based on a user’s activity level and contributions, fostering a sticky and participatory DeFi ecosystem.[5]

Treehouse is currently running Season 2 of its Point Farming campaign, where users can earn Nuts by providing liquidity on networks such as Arbitrum and Mantle. For example, staking 0.1 ETH yields 1 point per day, with additional bonuses for LP token staking. These Nuts points may later be used to redeem tokens or access official rewards.

How to participate:

- Visit the official Treehouse website and connect your wallet.

- Navigate to the Vaults page and provide liquidity to start earning points.

Recall

Recall (formerly known as Ceramic) is a decentralized data protocol designed to provide verifiable user data storage and access layers for AI and Web3 applications. By enabling trusted data sharing mechanisms, Recall empowers users to retain ownership over their identity and data across platforms. This is particularly applicable to use cases such as AI agents, on-chain identity, and social graphs.[6]

Currently, Recall is hosting a Point Farming campaign via Zealy and Galxe, where users can earn Fragments by completing specific tasks. These include obtaining Discord roles, inviting friends, and participating in AI agent matching tasks. All interactions contribute to points accumulation, which may lead to future airdrop eligibility or unlock exclusive ecosystem rewards.

How to participate:

- Visit the official Recall website and connect your wallet.

- Complete social tasks, such as following the official X (Twitter) account, to earn points.

- Finish designated missions on Zealy and Galxe platforms to accumulate more Fragments.

Sophon

Sophon is a decentralized platform focused on social identity and on-chain interactions. It leverages AI and zero-knowledge technologies to build a verifiable and portable reputation system on-chain. The project centers around the concepts of “on-chain personas,” “social graphs,” and “behavioral data,” offering a task system, NFT-based authorization, and interactive experiences to extract user value. Sophon aims to foster Web3 use cases such as content creation, DAO collaboration, and credentialing via incentive mechanisms.[7]

Sophon is currently in its Beta phase Point Farming campaign, offering point-based rewards through a task system. These points may translate into future airdrops or platform incentives. Users can stay updated via the official website or social channels.

How to participate:

- Visit the official Sophon website and connect your wallet.

- Complete tasks such as inviting three friends via a referral link or subscribing to their newsletter.

- Fulfill additional social tasks to accumulate more points.

Reminder

Airdrop plans and participation methods are subject to change at any time. Therefore, it is recommended that users follow the official channels of the above projects for the latest updates. Additionally, users should exercise caution, be aware of the risks, and conduct thorough research before participating. Gate does not guarantee the distribution of subsequent airdrop rewards.

Conclusion

Reviewing the market cycle from June 3 to June 16, 2025, the cryptocurrency market remained in a consolidation phase at high levels. Although a full-scale recovery has not materialized, structural capital rotation and selective thematic drivers have led to notable performances among some mid- and small-cap tokens, indicating that market interest has yet to significantly fade. The average return across the top 500 tokens by market cap was 16.65%, with tokens ranked 301–400 showing the most significant gains—exceeding 46%—demonstrating continued capital preference for assets with narrative appeal, thematic potential, and price flexibility.

From a volume perspective, projects like AURA and CONSCIOUS saw more than 100x increases in trading volume, making them short-term focal points in the market and signaling a strong appetite for breakout assets. The volume-price correlation chart further reveals that projects in the upper-right quadrant—those with both surging volume and steep price increases—were particularly favored. In contrast, some tokens experienced significant volume growth but lacked corresponding price movement, suggesting market disagreement on their future potential.

Overall, the current market is characterized by “rotating narratives and resilient blue chips,” with capital seeking opportunities in narrative-driven, high-volatility assets. Volume anomalies remain an important signal for identifying early-stage rallies and understanding market structure, especially for mid- and small-cap tokens where such indicators are more impactful. If macroeconomic and regulatory conditions remain stable, the market could build momentum during this consolidation period, laying the foundation for a stronger second half of the year.

On the airdrop front, the featured projects—OpenSea, Treehouse, Recall, and Sophon—stand out with their diverse application types, clearly defined task structures, and accessible participation routes. These projects focus on trending sectors such as NFTs, DeFi, decentralized identity, and AI data protocols. Each offers a well-positioned ecosystem with practical use cases and incentivizes ongoing engagement through points systems. As most campaigns are still in early or testing stages, users can accumulate points by completing designated tasks and become eligible for future airdrops or platform rewards. Continued participation not only increases the likelihood of receiving token incentives but also helps users gain familiarity with protocol operations and secure early-stage benefits.

Reference:

- CoinGecko, https://www.coingecko.com/

- Gate, https://www.gate.com/announcements/article/45594

- X, https://x.com/Uniswap/status/1933168423825035768

- OpenSea, https://opensea.io/rewards

- Treehouse, https://www.treehouse.finance/

- Recall, https://boost.absinthe.network/recall/dashboard

- Sophon, https://app.sophon.xyz/leaderboard

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides readers with in-depth content, including technical analysis, trending insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.