Can Project X, a "grassroots" company, replicate the growth trajectory of Hyperliquid?

Reposting original headline: “$40 Million Raised in Three Days—Can Grassroots Project X Replicate Hyperliquid’s Growth Path?”

Hyperliquid has established itself as one of the standout trading platforms of this market cycle, boasting daily trading volumes exceeding $15 billion and capturing more than 74% of the on-chain perpetuals market share. Its native token, HYPE, currently ranks 12th in cryptocurrency market capitalization. Hyperliquid’s vision goes beyond being a single on-chain trading platform; it aims to build an ecosystem centered around Hyper EVM.

Recently, a new project within the Hyper EVM ecosystem—Project X—has attracted significant community attention. In just three days after its launch, this DEX surpassed $40 million in total value locked (TVL). As a leading project, both Project X’s position within the ecosystem and the team’s background are generating strong interest.

To fully understand Project X’s origins, it’s essential to examine the founding team’s previous project, Pacmoon.

Pacmoon, a social meme project built on the Blast chain, utilized the “Yap model”—driving token value through social virality and community consensus. At its peak, Pacmoon achieved a fully diluted valuation (FDV) of over $200 million, making it a leading project within the Blast ecosystem. However, the current FDV of its token, PAC, has plummeted to just $35,000. This decline is partly due to the waning momentum of the Blast network and highlights the project’s ephemeral nature.

Per official documentation, Project X’s founders remain anonymous for now. The core team consists of seven members: Lamboland oversees growth, BOBBY manages product operations, hisho is responsible for product design, and Ali leads creative direction. In addition, the team includes a CTO with a Y Combinator background and two DeFi-native backend engineers.

Of the four publicly named members, all have participated in Pacmoon or Blast network development to varying extents, with Lamboland and BOBBY serving as Pacmoon’s founders.

Now, the team is focusing on DeFi infrastructure—specifically, building an AMM DEX (Automated Market Maker Decentralized Exchange). With Project X, they intend to break free from the “Uniswap copycat” model by innovating in distribution mechanisms, incentive design, and user experience to change the dynamics of trading platform competition. As their website puts it, “As technology converges, the next phase of DeFi will belong to those who can allocate value and design incentives most efficiently, keeping users engaged.”

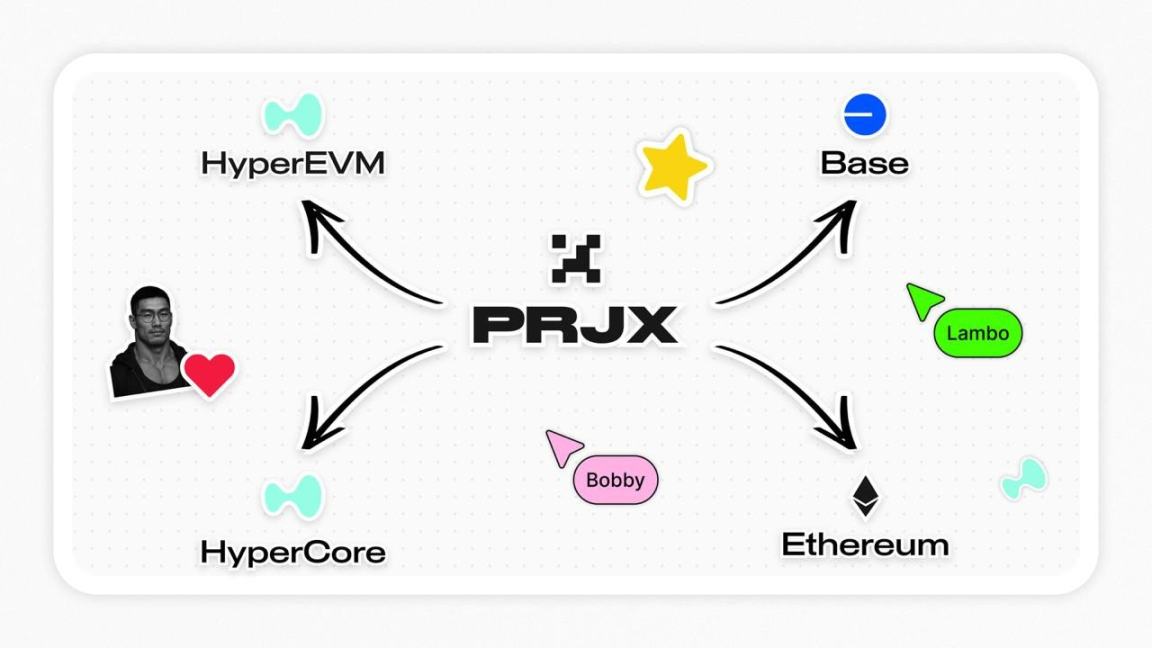

Project X’s development is structured in phases. The current focus is on Phase One: “HyperEVM DEX.” Subsequent stages will expand to an “EVM Aggregator” and an as-yet-undisclosed third phase, with the end goal of becoming “the leading platform for crypto trading.”

The core product adopts a “Uniswap-style AMM DEX” approach but differentiates itself through user experience and incentive mechanisms:

- Fee Distribution: In Version 3 (V3), 86% of trading fees go directly to liquidity providers (LPs), with the remainder supporting protocol operations. This puts Project X in the “high LP yield” tier of AMMs. The website explicitly states: “We want LPs to earn more on Project X.”

- V2 Pool Development: Although Version 2 hasn’t gone live yet, the team has signaled it will further enhance LP returns in the future using more advanced market-making strategies (like dynamic fees and cross-chain liquidity aggregation).

After completing the HyperEVM DEX build (Phase One), the second stage—“EVM Aggregator”—will focus on cross-chain trade aggregation. Project X will let users tap into liquidity across multiple EVM chains with a single click, directly addressing DEX fragmentation across multiple chains.

How to Participate

Project X’s points system is currently the linchpin of user growth. Points serve as the primary credential for participating in the ecosystem and may be directly tied to future token airdrops or ecosystem privileges.

Currently, points can be earned via clear “user contribution” pathways:

- Liquidity Provision (LP): Deposit assets into HyperEVM DEX liquidity pools (with kHYPE as the lead pool). The platform awards points based on the trading fees generated. The official site underscores that “most points go to LPs,” and point calculations align closely with “fee generation.” For instance, a user who deposits $1 million and generates $100 in fees will earn fewer points than someone who deposits $10,000 but generates $1,000 in fees.

- Trading: Completing spot trades on the platform (incurring trading fees) earns users points based on transaction size and frequency.

- Friend Referrals: Share your referral code for dual rewards: (1) Earn 10% of the points generated by your referred friends; (2) Increase your friends’ base point accrual by 10%. For example, if your friend could previously earn 100 points per day, after using your invitation, they receive 110 points daily.

To jumpstart the ecosystem, Project X has established short-term incentives:

- Daily 1 Million Points Pool: Each day in this phase, the platform distributes one million points, from which all user points are drawn.

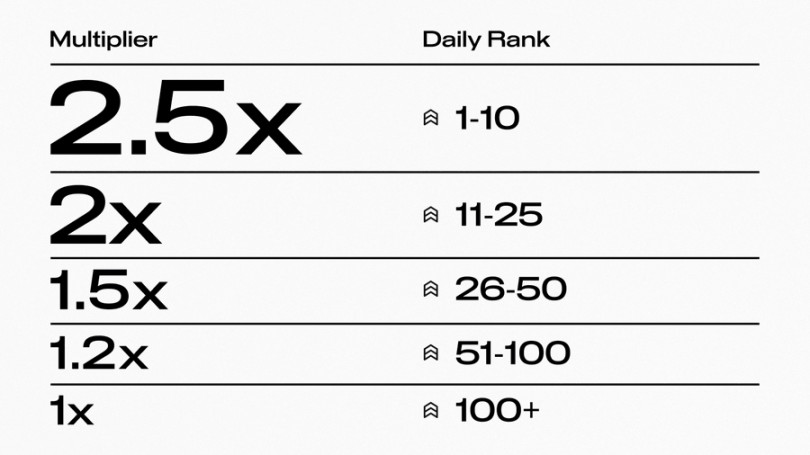

- First Month Point Multipliers: For the first 30 days, the top 100 users on the daily leaderboard receive a multiplier of 1x or higher on their daily points.

Notably, the project has recently updated its points system UI—the system now displays user point accrual in real time. However, specific airdrop rules—including the conversion rate between points and tokens, and the airdrop timeline—have not yet been announced, so users should confirm via official updates.

Risk Disclosure

Unlike most DeFi projects that rely on venture capital, Project X is entirely “grassroots” in its funding model: according to the website, it is 100% self-funded, with no VC, no angel, and no private investment involvement. This approach gives the team greater control and aligns with long-term project commitment.

However, the absence of external funding also means lower risk resilience. If the project faces severe market volatility or smart contract bugs, it may be unable to compensate users for losses.

Legal Notice:

- This article is a repost from [Foresight News], original headline: “$40 Million Raised in Three Days—Can Grassroots Project X Replicate Hyperliquid’s Growth Path?” Copyright remains with the original author, Nicky of Foresight News. If you object to this repost, please contact the Gate Learn Team and we’ll address concerns promptly according to our standard procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice of any kind.

- Other language versions are translated by the Gate Learn team. Unless specifically mentioned by Gate, reproduction, distribution, or plagiarism of translated articles is prohibited.

Share