Bitcoin (BTC) Price Prediction: Price Trends and Influencing Factors

Preface

After the historic 2024 Bitcoin halving, the market clearly enters a new narrative and value reassessment period in 2025. From global policy shifts and sovereign-level Bitcoin allocations to the heightened FOMO among enterprises and individuals, BTC is not just the king of crypto assets; it is gradually moving towards a consensus as a global digital reserve asset. This prelude to a bull market, resonating with policy, technology, narrative, and institutional involvement, is revealing that we may not be as far from the next Bitcoin price peak as we might imagine.

Bitcoin Price Prediction and Future Narrative

At the Bitcoin 2025 conference, Donald Trump Jr. publicly stated: the gateway for Bitcoin is opening, and he and his brother Eric Trump predict that BTC may surpass $170,000 by the end of 2026; BitMEX founder Arthur Hayes even claimed that the price of Bitcoin could reach $1,000,000 before 2028.

These statements are not made out of thin air, but are based on the backdrop of simultaneous advancements in capital scale, policy driving, and technology application. When global enterprises and governments begin to hold real assets in cryptocurrency, the investment allocation models of traditional funds will also change accordingly. Bitwise CEO Hunter Horsley stated: “If every wealth manager allocates 1% of assets to Bitcoin, that would result in an influx of hundreds of billions of dollars.”

Current Status of Institutional Holdings

Let’s take a look at the current holdings of several key institutions:

- Tether (USDT issuer): Currently holds over 100,000 BTC (worth over 10 billion dollars) and also hoards over 50 tons of gold.

- Paris Saint-Germain (PSG): The first top football club to publicly hold Bitcoin, converting part of its fiat currency reserves into BTC.

- Cantor Fitzgerald: Plans to launch a gold-backed Bitcoin fund to open the door for traditional conservative investors.

The scope of regulation is gradually becoming clear.

The internal regulatory stance of the US SEC (Securities and Exchange Commission) towards cryptocurrencies has also seen a subtle shift, with SEC crypto working group head Hester Peirce emphasizing:

- Investing in cryptocurrency requires taking responsibility for oneself.

- Most cryptocurrencies are not securities, and trading platforms do not necessarily have to register with the SEC.

It was even explicitly stated that meme coins, certain mining activities, and stablecoins will not be under the jurisdiction of the SEC, which means that the regulatory framework will be more flexible and open up more space for innovation.

Michael Saylor: Buying Bitcoin is igniting the flame of freedom.

As a staunch representative of Bitcoin, MicroStrategy founder Michael Saylor once again ignited the audience with an inspiring speech. He called for:

- Take out your fiat currency and exchange it for Bitcoin; take out your future and bet on Bitcoin.

Saylor believes that there is a 90% chance of successfully allocating BTC within 5 years. The first of his 21 rules for wealth is: courage and faith. For the crypto community, this is not just advice for wealth, but also a belief and a revolution.

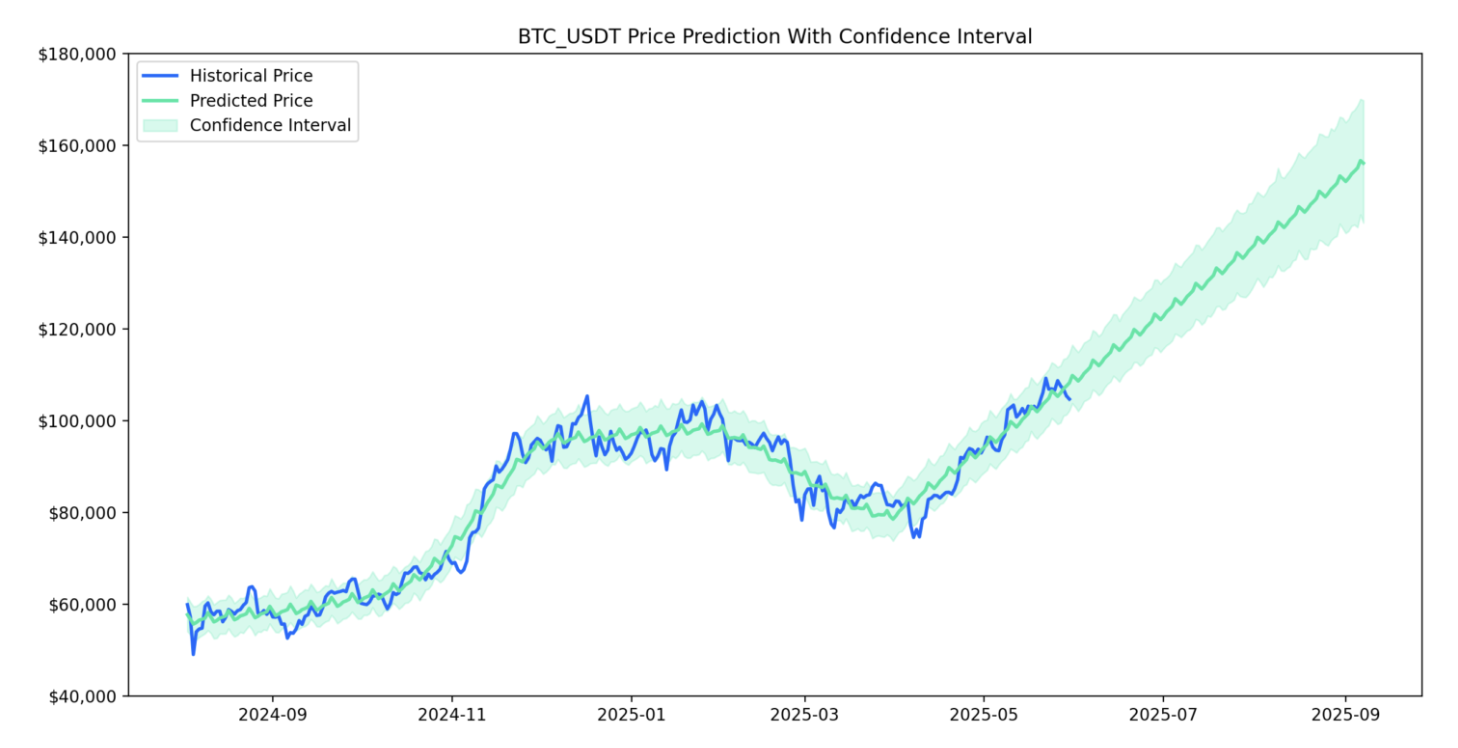

Bitcoin price prediction

Through AI model data calculations, referencing past BTC prices and related information, predictions for future prices are made, intended solely for data sharing and not as investment advice. Refer to the following chart:

Bitcoin price prediction trend

BTC price prediction and confidence interval

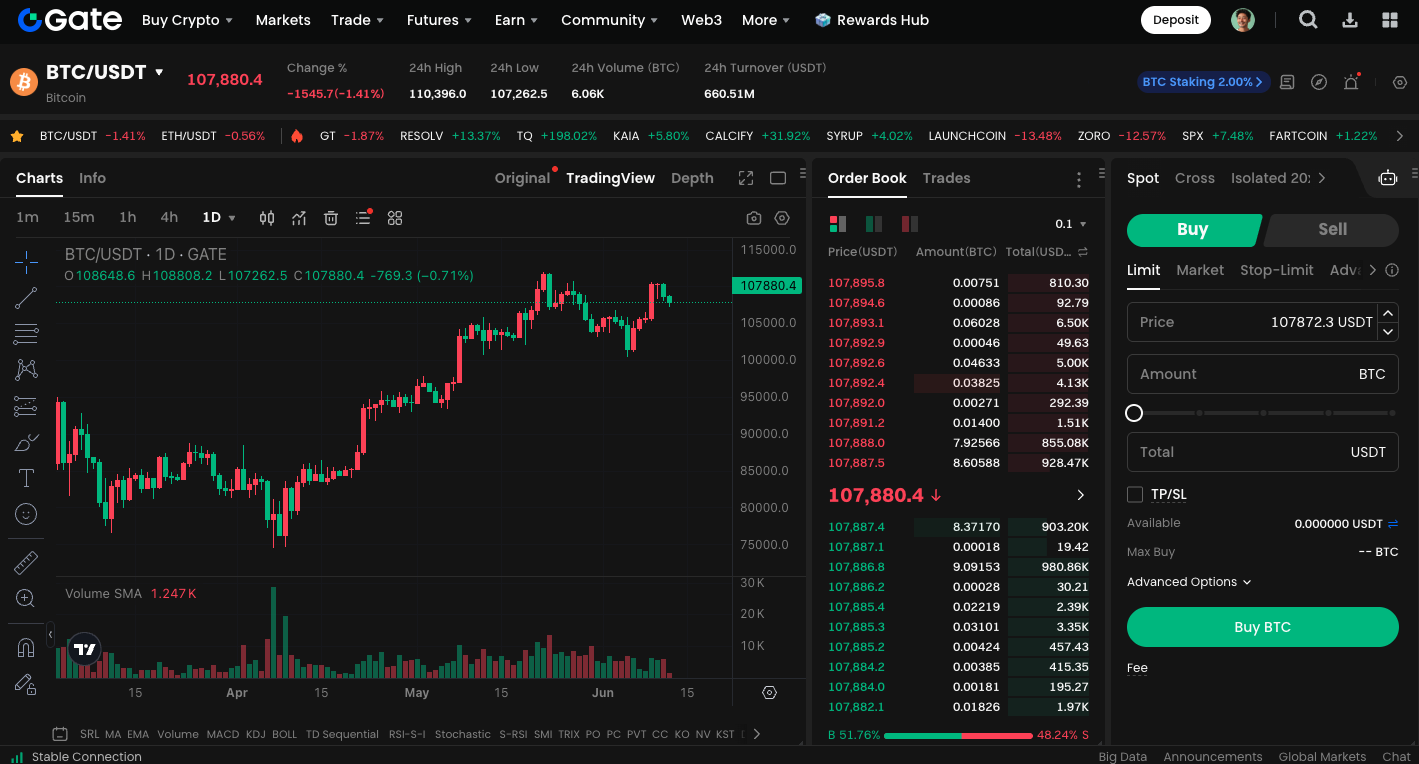

Start trading BTC spot immediately:https://www.gate.com/trade/BTC_USDT

Summary

As policies warm up, companies enter the market, technology matures, and market consensus gradually establishes, Bitcoin evolves from an asset into a strategy, narrative, and choice for the future. This is a redefinition of global capital and value storage, as well as a challenge and reconstruction of the traditional financial order.