A Rational Choice to Withstand BTC Volatility: On-Chain Staking at 2.99% APY for Easy Gains

BTC Current Market Overview

Chart: https://www.gate.com/trade/BTC_USDT

As of early August 2025, after a strong breakout in mid-July that saw Bitcoin reach a peak of $123,220, the price has since pulled back and is now consolidating around $114,800. The data shows that Bitcoin is in a period of price consolidation within a broad range, with strong resistance above and robust support below, making any short-term upward breakthrough unlikely. The broader market reflects a tug-of-war between bulls and bears, with heightened speculative risk.

In this environment, many BTC holders have opted to trade less frequently and allocate their BTC to on-chain staking products for stable returns while waiting for a new uptrend to emerge.

Managing BTC Positions During High-Volatility Phases

Traditional HODL strategies can work well in bear markets, but during periods of high volatility, when prices swing back and forth, actual returns frequently fall short of expectations. Meanwhile, frequent trading leads to high transaction fees and potential losses.

As a result, more investors are turning to “hold-and-earn” approaches, such as on-chain staking, stablecoin strategies, or automated yield farming, to generate steady returns. For BTC holders, on-chain staking offers a way to create positive cash flow without liquidating assets.

What Is BTC On-Chain Staking?

On-chain staking is the process of entrusting your BTC to a platform, which then puts it to work through on-chain protocols—such as providing liquidity, operating nodes, or other approved strategies—to generate yield. Unlike traditional lending or lock-in solutions, on-chain staking strikes an optimal balance between liquidity, security, and stable returns.

Gate offers a BTC on-chain staking solution as a non-custodial service with full transparency. Users can monitor on-chain details in real time, giving them confidence in both fund safety and yield authenticity.

How Gate BTC On-Chain Staking Works

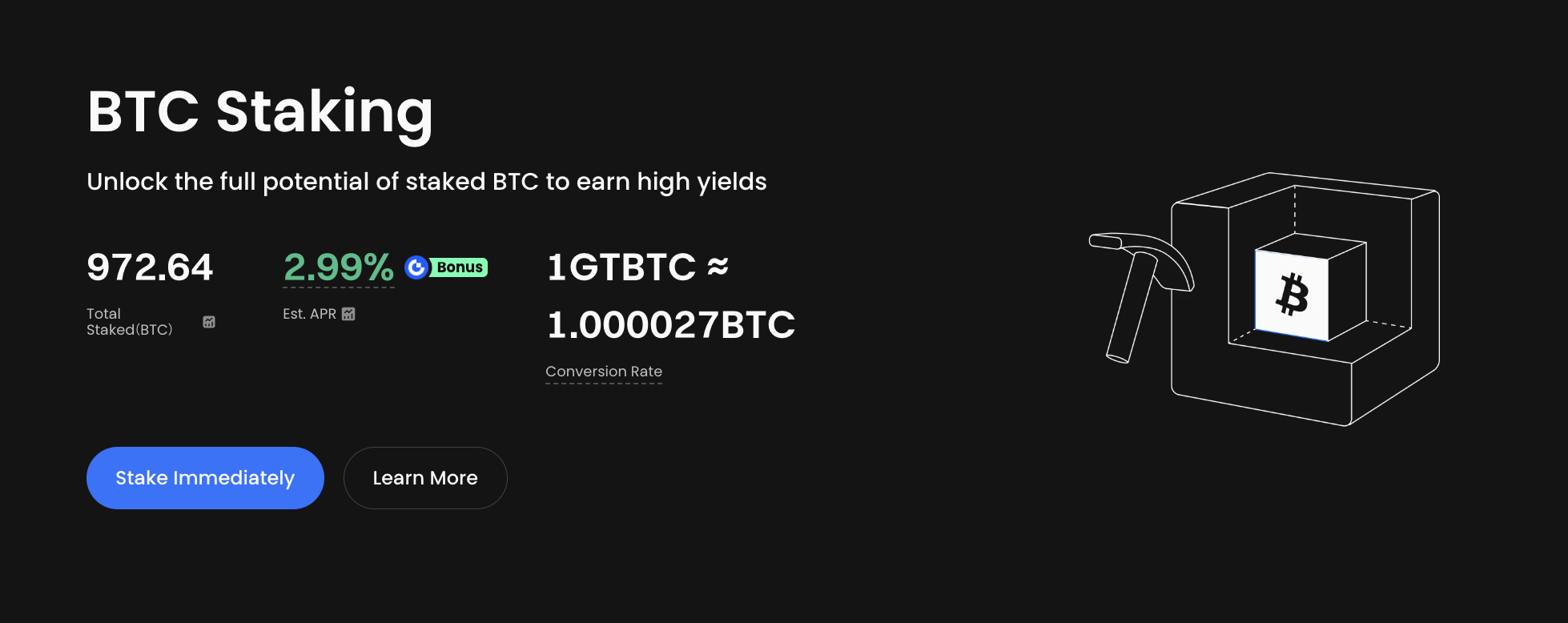

Chart: https://www.gate.com/staking/BTC

Gate’s BTC on-chain staking product features a straightforward, transparent mechanism:

- When users stake BTC, the platform issues GTBTC as a 1:1 receipt token;

- The platform calculates returns daily based on GTBTC balance at the set annual percentage rate (APR);

- The system automatically calculates and distributes all earnings on-chain—no manual intervention or delays;

- Users can redeem at any time by converting GTBTC one-for-one back to BTC, immediately credited to their account;

- A user-friendly interface allows for one-click management on both web and mobile.

2.99% Annual Yield: The Source of Stable Returns

The current reference annual yield for BTC on-chain staking stands at 2.99%. Gate generates these returns by deploying BTC in approved on-chain activities, including providing liquidity to mining pools and participating in high-liquidity staking projects.

Compared to staking offerings in the market with highly variable yields or complex designs, Gate’s BTC staking product offers distinct advantages:

- Clear, transparent annual yield with minimal volatility;

- No minimum position—small-scale users are welcome;

- Daily settlement and crediting of all returns, with transparent earnings details;

- No redemption lockup—users can adjust strategies at any time in response to market trends.

This approach is highly attractive for risk-averse investors and those with a long investment horizon, providing optimal passive income.

How to Stake and Redeem Yields

Participating in Gate BTC on-chain staking is straightforward:

- Log into your Gate account and confirm you have BTC;

- Go to the “On-chain Earn” page, select the BTC staking option, and click “Stake”;

- Confirm your stake to receive an equal amount of GTBTC;

- Daily, the system automatically calculates and credits your returns to your account;

- To redeem, convert GTBTC back to BTC at any time—funds are credited immediately.

No need for advanced wallet management or node operations—this process is accessible to users of all experience levels.

Who Should Consider On-Chain Staking?

BTC on-chain staking is particularly well suited for:

- Long-term BTC holders not looking to cash out soon;

- Beginners preferring stable returns over active trading;

- Risk-averse investors seeking stability amid market swings;

- Anyone seeking a low-risk, high-liquidity crypto yield tool.

Importantly, on-chain staking does not restrict your ability to make market calls or reallocate assets. You can redeem BTC at any time to trade or rebalance, with no lock-in period.

Summary: Low Risk, High Liquidity, Daily Earnings—BTC Staking at Its Best

When the BTC market is in a sideways phase, investors often feel stuck between two options. Instead of risking frequent trades, consider a low-risk, stable BTC on-chain staking approach. Gate’s product delivers up to 2.99% annual yield, with daily interest payouts and instant redemption, offering an optimal blend of yield and flexibility.

If you already own BTC and want to put your crypto to work, on-chain staking is a compelling way to enhance asset efficiency and achieve genuine passive growth.

Share

Content