- Topic1/3

16k Popularity

23k Popularity

18k Popularity

54k Popularity

20k Popularity

- Pin

- 📢 Gate Square #Creator Campaign Phase 2# is officially live!

Join the ZKWASM event series, share your insights, and win a share of 4,000 $ZKWASM!

As a pioneer in zk-based public chains, ZKWASM is now being prominently promoted on the Gate platform!

Three major campaigns are launching simultaneously: Launchpool subscription, CandyDrop airdrop, and Alpha exclusive trading — don’t miss out!

🎨 Campaign 1: Post on Gate Square and win content rewards

📅 Time: July 25, 22:00 – July 29, 22:00 (UTC+8)

📌 How to participate:

Post original content (at least 100 words) on Gate Square related to

- 📢 Gate Square #MBG Posting Challenge# is Live— Post for MBG Rewards!

Want a share of 1,000 MBG? Get involved now—show your insights and real participation to become an MBG promoter!

💰 20 top posts will each win 50 MBG!

How to Participate:

1️⃣ Research the MBG project

Share your in-depth views on MBG’s fundamentals, community governance, development goals, and tokenomics, etc.

2️⃣ Join and share your real experience

Take part in MBG activities (CandyDrop, Launchpool, or spot trading), and post your screenshots, earnings, or step-by-step tutorials. Content can include profits, beginner-friendl

- 🎉 Gate Square’s "Spark Program" Surpasses 1,000 KOLs!

💥 The creator ecosystem is in full bloom!

📈 Get featured, earn rewards, and grow your influence—what are you waiting for?

💰 Cash incentives ✔️

🚀 Traffic support ✔️

👑 Exclusive verification ✔️

From 0 to 1,000 in just weeks—Gate Square is becoming the epicenter of Web3 content! ⚡

You’re not just posting content, but the next "viral opportunity"!

🌟 Join the Spark Program and kickstart your breakthrough!

👉 https://www.gate.com/announcements/article/45695

- 📢 #Gate Square Writing Contest Phase 3# is officially kicks off!

🎮 This round focuses on: Yooldo Games (ESPORTS)

✍️ Share your unique insights and join promotional interactions. To be eligible for any reward, you must also participate in Gate’s Phase 286 Launchpool, CandyDrop, or Alpha activities!

💡 Content creation + airdrop participation = double points. You could be the grand prize winner!

💰Total prize pool: 4,464 $ESPORTS

🏆 First Prize (1 winner): 964 tokens

🥈 Second Prize (5 winners): 400 tokens each

🥉 Third Prize (10 winners): 150 tokens each

🚀 How to participate:

1️⃣ Publish an

[U.S. Stocks: Stock Discovery] Insurance Sector: Specialty Insurance Market is Rapidly Growing | U.S. Stocks, Industry Trends, and Stock Analysis | Moneyクリ Money Forward Securities' Investment Information and Money-Helpful Media

Ryan Specialty Group Holdings [RYAN], an expert in specialty insurance

The E&S market is expanding at more than double the pace of the general property and casualty insurance market.

In the past, topics like "(soccer player) David Beckham took out a £100 million insurance policy on his legs" and "Mariah Carey has insured her vocal cords" occasionally made headlines in sports newspapers. The truth of these claims is uncertain, but it is said that insurance known as specialty, which addresses the risks of a minority, has developed in the UK and the US.

Ryan Specialty Group Holdings [RYAN] is an expert in specialty insurance. It is a field that requires advanced expertise, know-how, and technology, but since its founding by current chairman Patrick Ryan in 2010, it has expanded its operations in line with the rapid growth of the market.

In the United States, a market that addresses specialized risks not covered by general insurance companies is called the Excess and Surplus Market (E&S Market). From 2010 to 2023, the annual average growth rate of the E&S Market (based on direct premium income) is 10.5%, expanding at more than twice the pace of the average growth rate of the general property and casualty insurance market, which is 4.6%.

Specialty Insurance Brokerage: 61% Commission Income

The company's main business is the brokerage of specialty insurance. The wholesale insurance brokerage business, which connects retail brokers and agents with E&S specialty insurance companies, is the largest, accounting for 61% of total commission income (for the fiscal year ending December 2024).

The strength lies in the strong relationships with retail brokers and agents who sell insurance products to customers on the front line. The company explains that it has established a system that allows it to efficiently wholesale insurance products to retail brokers and agents across all 50 states in the United States.

In the wholesale business developed under brands such as "RT Specialty", we handle real estate insurance, disaster insurance, household insurance, professional and director liability insurance, workers' compensation insurance, transportation insurance, and more.

Contents of various specialty insurance

Real estate insurance covers general residences, condominiums, commercial facilities, and mixed-use developments, and it is possible to insure against not only floods, earthquakes, wildfires, and storms but also terrorism and pandemics.

Home insurance offers a variety of products. For example, there is coverage for classic cars in collections, as well as liability insurance for accidents that occur while using snowmobiles or jet skis.

The professional liability insurance for professionals and executives under the "RT ProExec" brand addresses the risks faced by professionals and corporate officers. One of the primary risks for professionals is medical malpractice; however, it seems that products are also available for doctors, dentists, midwives, and others.

In addition, one of the financial risks faced by company executives is shareholder derivative lawsuits, but this can be addressed with liability insurance. Additionally, insurance products targeting company executives that cover kidnapping and ransom are eye-catching.

Underwriting Authority Business: 13% of Fee Income

In addition to its core wholesale business, it also engages in the underwriting authority business for insurance contracts. This involves insurance companies granting underwriting authority and management/sales responsibilities to Ryan Specialty, enabling them to respond quickly to complex risks in accordance with predetermined underwriting criteria. The underwriting authority business accounts for 13% of total fee income.

Underwriting Management Business: 26% of commission income

In addition, in the underwriting management business, product design, insurance underwriting, and coverage setting are handled through insurance agents and underwriting companies commissioned by insurance companies. The proportion of total commission income reaches 26%.

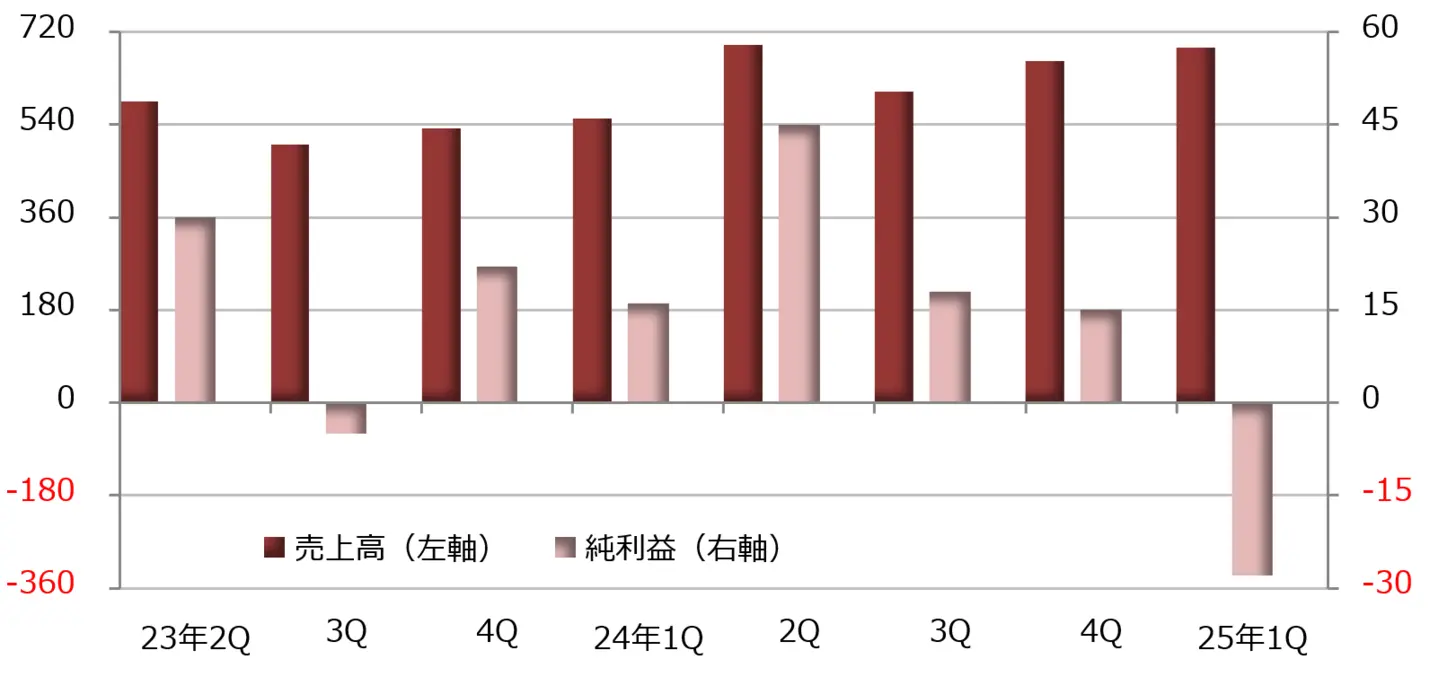

[Chart 1] Ryan Specialty Group Holdings [RYAN]: Performance Trends (Unit: Million USD) Source: Created by DZH Financial Research from LSEG

※The end of the term is December

Source: Created by DZH Financial Research from LSEG

※The end of the term is December

[Figure 2] Ryan Specialty Group Holdings [RYAN]: Weekly Chart (Moving Average Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of June 20, 2025)

Source: Monex Securities website (as of June 20, 2025)

Progressive [PGR], Strong in Auto Insurance

Progressive [PGR] is engaged in the property and casualty insurance business. It mainly underwrites automobile insurance for individuals and corporations, as well as homeowners insurance and motorcycle insurance.

The net premium income for the fiscal year ending December 2024 increased by 21% year-on-year to $74.424 billion, showing steady growth. In terms of segments, the personal business is overwhelmingly large, with net premium income rising by 23% to $63.47 billion, accounting for 85% of the total.

In personal business, in addition to standard auto insurance, we also offer specialty insurance that covers motorcycles, recreational vehicles (RVs), jet skis, and more. For the fiscal year ending December 2024, the net premium income for personal auto insurance is $60.399 billion, accounting for 81% of the total. Homeowners insurance makes up about 4% of the total.

Corporate business mainly targets owners of small and medium-sized enterprises. It covers insurance for commercial vehicles and industrial machinery, as well as business-related liability insurance and workers' compensation insurance. The net premium income for corporate business has increased by 8% to $10.953 billion, accounting for 15% of the total.

[Chart 3] Progressive [PGR]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is December

Source: Created by DZH Financial Research from LSEG

*The end of the term is December

[Chart 4] Progressive [PGR]: Weekly Chart (Moving Average Line Green: 13 weeks, Orange: 26 weeks) Source: Monex Securities Website (as of June 20, 2025)

Source: Monex Securities Website (as of June 20, 2025)

Marsh & McLennan [MMC], Integrating Risk Management and Insurance

Marsh & McLennan [MMC] provides risk management and insurance services. They serve individuals and corporations in over 130 countries, operating under four brands.

The segment is divided into the Risk & Insurance Services division and the Consulting division, with Risk & Insurance Services being the core division that generates approximately 63% of sales for the fiscal year ending December 2024. Among these, "Marsh" handles risk management, insurance program management, risk consulting, analytical modeling, and risk financial services for clients. The sales ratio is approximately 53%.

Another brand is "Guy Carpenter," which mainly engages in reinsurance brokerage, strategic advisory services, and analytical solutions. The sales ratio is about 10%.

The consulting division accounts for about 37% of total sales. Among these, the "Mercer" brand is responsible for organizational and human resource management consulting, with a sales ratio of approximately 23%.

The consulting division is handled by "Oliver Wyman", which specializes in management consulting. They possess expertise in areas such as organizational strategy formulation, operations, risk management, and organizational restructuring, operating in 34 countries. The revenue ratio is approximately 14%.

[Figure 5] Marsh & McLennan [MMC]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is December

Source: Created by DZH Financial Research from LSEG

*The end of the term is December

[Figure 6] Marsh & McLennan [MMC]: Weekly Chart (Moving Average Lines Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of June 20, 2025)

Source: Monex Securities website (as of June 20, 2025)

Travelers Companies [TRV], a long history in insurance

Travelers Companies [TRV] is a leading property and casualty insurance company in the United States. The founding of its predecessor dates back to 1853 when Perry arrived in Japan. After a long history of merging and consolidating, it has grown into a huge group. It was added to the Dow Jones Industrial Average in June 2009 and has not been excluded since.

The segments are divided into corporate insurance, personal insurance, guarantee insurance, and specialty insurance. The corporate insurance division offers a wide range of plans, including commercial vehicle and truck insurance, property insurance, marine insurance, workers' compensation, cyber insurance, small business owner insurance, and environmental liability insurance, to meet customer needs. For the fiscal year ending December 2024, the net premium income is expected to be $22.078 billion, an 8% increase compared to the previous year, accounting for approximately 51% of the total.

Personal insurance includes major products such as auto insurance, homeowners insurance, travel insurance, pet insurance, motorcycle insurance, and jewelry & high-value items insurance. The net income premium increased by 8% to $17.169 billion, accounting for approximately 40% of the total.

Surety insurance and specialty insurance cover surety bonds that target the fulfillment of corporate contracts, fidelity bonds that cover losses due to fraudulent acts by employees or executives, directors and officers liability insurance that addresses litigation risks faced by corporate management, and professional liability insurance. The net premium income increased by 7% to $4.1 billion, accounting for approximately 9% of the total.

[Figure 7] Travelers Companies [TRV]: Performance Trends (in millions of dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is December

Source: Created by DZH Financial Research from LSEG

*The end of the term is December

[Figure 8] Travelers Companies [TRV]: Weekly Chart (Moving Averages Green: 13-week, Orange: 26-week) Source: Monex Securities website (as of June 20, 2025)

Source: Monex Securities website (as of June 20, 2025)

MetLife [MET], one of the largest life insurance companies in the United States

MetLife [MET] is one of the largest life insurance companies in the United States, also dealing in pension and property insurance. Founded in 1868, it has a history of over 150 years. Although it may be a recent event in its long history, in 2010, MetLife expanded its business by acquiring Alico, a major life insurance company that faced management difficulties due to the Lehman Shock.

The segments are divided into the Group Insurance Division, Retirement and Pension Division, Asia Division, Latin America Division, Europe, Middle East and Africa (EMEA) Division, and Holding Division.

In the group insurance sector, we have established a strong position in the U.S. group insurance market based on long-standing relationships with major companies. The plans we offer include life insurance, dental insurance, disability income insurance, individual disability income insurance, accidental death and dismemberment (AD&D) insurance, and accident and sickness insurance.

In the retirement benefits and pension sector, we provide solutions aimed at reducing the burden of employee benefit systems for corporations and other entities. We offer measures for burden reduction and financing using life insurance, pension insurance, and investment products.

[Chart 9] MetLife [MET]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is December

Source: Created by DZH Financial Research from LSEG

*The end of the term is December

[Chart 10] MetLife [MET]: Weekly Chart (Moving Averages Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of June 20, 2025)

Source: Monex Securities website (as of June 20, 2025)