Fidelity filed the S-1 form for its Solana ETF at the SEC.

The regulator’s active engagement with potential SOL ETF issuers catalyzed speculations that it may give the green light for their investment products as early as July.

The countdown is closing in for the final deadline of altcoin-based spot exchange-traded funds (ETFs) in the US. Industry observers expect the US Securities and Exchange Commission (SEC) to give its decisive verdict on the basket ETFs of Grayscale, Bitwise, Hashdex, and Franklin Templeton on July 2, 2025.

Following them are the Litecoin (LTC) and Solana (SOL) ETFs, which are anticpated to be introduced in October this year. However, several analysts suspect that the latter may arrive earlier than expected due to rising public demand and interest.

Fidelity Solana ETF Amendment

One of the biggest issuers of the SOL ETFs is Franklin Templeton. In light of the recent developments, the investment manager, together with Galaxy Digital and VanEck, has filed its S-1 application with the regulator.

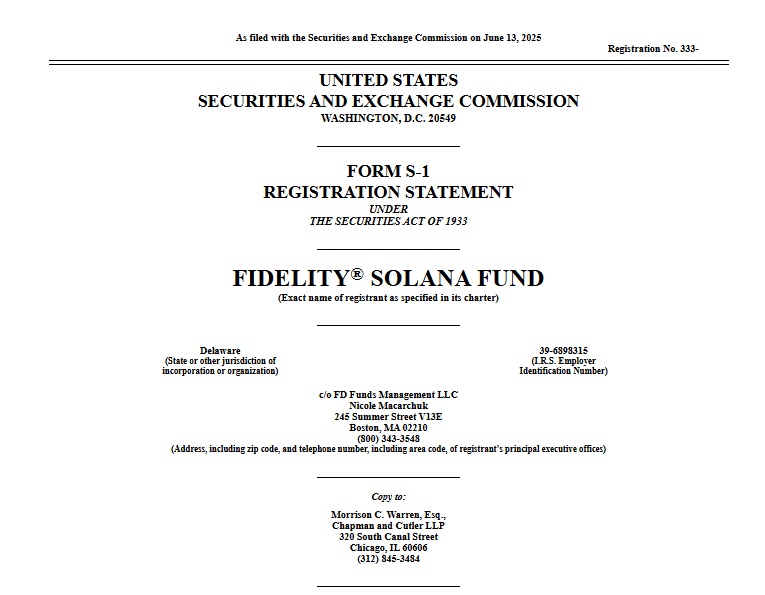

ADVERTISEMENTFidelity’s S 1 Form for Solana ETF (Source: US SEC)The move reportedly came after the SEC asked the potential Solana ETF issuers to resubmit the amended versions of their applications. The securities watchdog notably instructed them to revise the in-kind redemption and staking provisions that they want to integrate into the new products.

Investor sentiment and lobbying by cryptocurrency groups have apparently led the regulator to reconsider its previous stance against these schemes. Former SEC Chair Gary Gensler’s regime had earlier rejected in-kind redemption for the Bitcoin (BTC) ETFs launched in January last year, opting instead for in-cash redemption. Additionally, it declined to render judgment on the proposed staking features of Ethereum (ETH) ETFs.

SOL ETF Odds of Approval

The SEC’s active engagement with the Solana ETF applicants has triggered widespread speculation that it may be looking to approve their investment products way before the October deadline. Some also suggested the possibility of a favorable decision coming in July.

ADVERTISEMENTBacking these up were the positive outlooks of Bloomberg ETF analysts James Seyffart and Eric Balchunas. Both experts have recently updated their forecasts, reflecting a 90% chance of approval for Solana ETFs, alongside their Litecoin counterparts and the pending basket ETFs.

Crypto ETF Chances of Approval (Source: James Seyffart via X)Even the decentralized prediction platform Polymarket indicated the same sentiment from the public. A majority, or 91%, of participants in one of its events are bullish about the SEC giving SOL ETFs a go this year.

Solana ETF Approval Prediction (Source: Polymarket)As of Sunday, Solana’s price moved between a $142.23 low and a $148.83 high, bringing the market cap of its 527.75 million tokens in circulation from $75.052 billion to $78.545 billion. Meanwhile, Fidelity’s existing Bitcoin and Ether ETFs have already accumulated $11.527 billion and $1.608 billion in total inflows, respectively.

The content is for reference only, not a solicitation or offer. No investment, tax, or legal advice provided. See Disclaimer for more risks disclosure.

Fidelity Investments Files S-1 Form At The SEC For Solana ETF

The countdown is closing in for the final deadline of altcoin-based spot exchange-traded funds (ETFs) in the US. Industry observers expect the US Securities and Exchange Commission (SEC) to give its decisive verdict on the basket ETFs of Grayscale, Bitwise, Hashdex, and Franklin Templeton on July 2, 2025.

Following them are the Litecoin (LTC) and Solana (SOL) ETFs, which are anticpated to be introduced in October this year. However, several analysts suspect that the latter may arrive earlier than expected due to rising public demand and interest.

Fidelity Solana ETF Amendment

One of the biggest issuers of the SOL ETFs is Franklin Templeton. In light of the recent developments, the investment manager, together with Galaxy Digital and VanEck, has filed its S-1 application with the regulator.

ADVERTISEMENT Fidelity’s S 1 Form for Solana ETF (Source: US SEC)The move reportedly came after the SEC asked the potential Solana ETF issuers to resubmit the amended versions of their applications. The securities watchdog notably instructed them to revise the in-kind redemption and staking provisions that they want to integrate into the new products.

Fidelity’s S 1 Form for Solana ETF (Source: US SEC)The move reportedly came after the SEC asked the potential Solana ETF issuers to resubmit the amended versions of their applications. The securities watchdog notably instructed them to revise the in-kind redemption and staking provisions that they want to integrate into the new products.

Investor sentiment and lobbying by cryptocurrency groups have apparently led the regulator to reconsider its previous stance against these schemes. Former SEC Chair Gary Gensler’s regime had earlier rejected in-kind redemption for the Bitcoin (BTC) ETFs launched in January last year, opting instead for in-cash redemption. Additionally, it declined to render judgment on the proposed staking features of Ethereum (ETH) ETFs.

SOL ETF Odds of Approval

The SEC’s active engagement with the Solana ETF applicants has triggered widespread speculation that it may be looking to approve their investment products way before the October deadline. Some also suggested the possibility of a favorable decision coming in July.

ADVERTISEMENTBacking these up were the positive outlooks of Bloomberg ETF analysts James Seyffart and Eric Balchunas. Both experts have recently updated their forecasts, reflecting a 90% chance of approval for Solana ETFs, alongside their Litecoin counterparts and the pending basket ETFs.

ADVERTISEMENT